Research advisor:

Bass Alexander Borisovich,

PhD in Economics, Associate Professor, Department of Monetary Relations & Monetary Policy

The Swiss Central Bank (SCB – Swiss Central Bank) in contrast to the respective banks of most European countries does not have the status of a public institution, and is a joint stock company with special status and is operated with the participation and under the supervision of the Confederation of Switzerland. It was organized as a joint stock company according to the results of a referendum held in 1906. The relevant law was adopted in the same year. The Swiss Central Bank has a monopoly right to issue the national currency and from 1907 issues the currency that is the Swiss franc (the coins are produced by Switzerland Mint). The Bank issues shares that are traded on the exchange market. Equity of Bank of Switzerland is 50 million Swiss francs. About 55% of its shares is owned by public entities. The remaining shares are traded on the stock markets. The Swiss Central Bank in accordance with p. 99 of the Constitution of Switzerland conducts an independent monetary and currency policy that serves the general interest of the country. [1] The main functions of a Swiss Bank:

1. The conduct of monetary policy to maintain price stability;

2. The implementation of a guaranteed offer of cash currency, has the privilege of printing banknotes.

3. The management of international reserves (which includes reserves of gold, currencies, instruments of international payments).

4. The stability of the financial system.

5. Non-cash payments.

6. Publication of statistical reports.

The most important task of the SCB is the conduct of monetary policy, which is to ensure price stability and that the economy is serving the interests of the country as a whole. The main instruments of monetary policy of the Central Bank of Switzerland are the following:

1. The target range of the interest rate. The SCB conducts monetary policy by setting a target range for its three-month rate (the Swiss LIBOR rate). This range usually has a spread of 100 b.p. and is reviewed at least once per quarter. This rate is used as the target because it is the most important money market rate for investments in Swiss francs. Change of this rate due to changes in economic conditions are accompanied by clear explanations of the specific situation.

2. Operations on the open market.

REPO transactions – sale by the payee (borrower) of securities to the provider of money (the creditor) with a simultaneous agreement to buy back securities of the same kind and in the same amount at a later date. REPO transactions usually have very short maturities — from one day to several weeks. The SCB uses repo transactions to counteract undesirable movements of three-month LIBOR. To avoid exceeding the three-month LIBOR set level, the SCB provides commercial banks with additional liquidity through REPO transactions at lower rates and, in fact, creates additional liquidity. On the contrary, increasing REPO rates, the SCB can reduce liquidity or initiate the growth of three-month LIBOR.

The SCB conducts evaluations of monetary policy in March, June, September and December. Each of these ratings affect the interest rate decision and medium-term forecast level of inflation. The rationale of all decisions taken by the SCB is published in its press releases and quarterly reports. In addition, information about monetary policy of SCB is provided in press conferences of the Chairman of SCB governing Council, held annually in June and December. In recent developments of monetary policy one should include a waiver of the minimum fixed exchange rate for the Franc/Euro and reduced interest rates to minus 0.75%. [2]

In December 2014 SCB abandoned the minimum exchange rate for the franc per Euro 1,20 and reduced the interest rate to -0.75%. Thus, the target range of interest rates became negative. At the same time, an interest rate on account balances exceeding a maximum of 0.5 percentage points was reduced to minus 0.75%. This shifts the target range for three-month LIBOR rate to negative values between -1,25% and -0,25%. The minimum exchange rate of Franc/Euro was introduced in the period of the overvalued Swiss franc and uncertainty in the financial markets. It was an exceptional and temporary measure. And despite the fact that the franc is still high, the revaluation has generally decreased. The Euro has significantly depreciated against the dollar, and this caused a depreciation of the Swiss franc against the U.S. dollar. Given these conditions, the SCB concluded that enforcing and maintaining the minimum rate of the Swiss franc against the Euro is not justified. Lowering interest rates was in order to the termination of the minimum exchange rate that has not led to a tightening of monetary policy. And if necessary SCB will be active in the foreign exchange market to influence monetary policy. In the opinion of management of the Central Bank, price stability corresponds to the rate of inflation not higher than 2%. In the formulation of monetary policy of inflation and deflation the SCB focuses on private inflation forecasts. Base for the formulation of monetary policy are the forecasts for the medium-term inflation. Along with this, the SCB sets an operational target range of interest rates on three-month LIBOR.

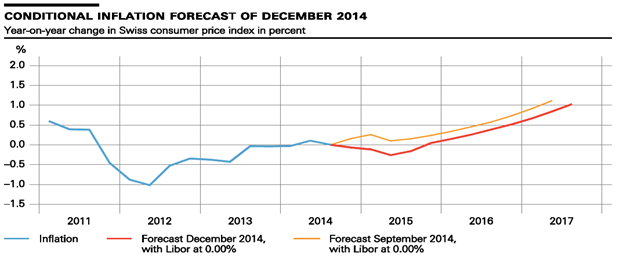

In 2014 the Swiss Bank has revised its inflation forecast downwards by 0.1 percentage points to 0.0%. For 2015, the inflation forecast was negative and amounted to -0,1%. Only in 2016 is inflation expected to rise slightly by 0.3%. These projections assume that three-month LIBOR will remain at zero throughout the forecast horizon, and that the Swiss franc will weaken. Overall, the prospects of the world economy are still dominated by downside risks – the most important of which are the continuing difficult conditions in the Euro area and a possible escalation of geopolitical tensions. [1]

Figure 1 presents a forecast of SCB at the time of December 2014, where the blue curve is the inflation rate until December 2014, the orange curve shows the inflation forecast as at September 2014 with LIBOR at 0.00%, and the red curve is the forecast for inflation as of December 2014 based on LIBOR at 0.00%. The calculation of this indicator was made as the annual change of the consumer price Index of Switzerland in percent. [3]

The graph shows that the forecast level of inflation in the long term increases, although the forecast in December was changed from September with more than a sharp rise in inflation in more than a slight increase in inflation. In mid-January 2015, the SCB abandoned the restrictions on the foreign exchange market, although still is calling the ceiling rate of national currency to Euro as one of the foundations of monetary policy.

Figure 1. Inflation Forecast of the Swiss Confederation as of December 2014.

Source: Switzerland National Bank.

This undermines the status of the franc as a reserve currency. The reason is the change in the global monetary policy (the Federal Reserve was planning on raising rates, the ECB and the Bank of Japan on the contrary – decrease). The SCB assumed that the ECB will announce a big program of government bond purchases, and supporting the franc in these circumstances, it would be very costly for the SNB. After the decision, the Euro initially rose to a record 85 centimes per Euro, then fell to 1,0245. Before that, for three years the “ceiling” of the franc to the Euro operated, amounting to 1.2 Swiss francs per Euro. Swiss producers lost 11-15% of capitalization. SMI stock index declined by 8.7%, during the session, the drop reached 14%. The SCB also lowered January interest rate on sight deposits to – 0.75% from minus 0.25% and has expanded the target range of the key rate – three-month LIBOR to minus 1.25 and 0.25 per cent to minus 0.75 is 0.25%. It should be noted that, although the franc to the Euro is still high, the overvaluation of the Swiss currency has decreased since the introduction of the “ceiling”. The economy has been able to take advantage that gave this phase, and to adapt to the new situation.

Thus, in our view, authorities of the Central Bank of Switzerland are conducting a very successful monetary policy, and the result is that inflation in the country is at a low level. In considering whether to adopt something or use in the practice of formulating monetary policy, the Central Bank of Russia should be borne in mind. First, it is necessary to consider the economic and political situation of a particular country. This means that the mechanisms used by the Central Bank of one country, most likely, would not be applicable for practice of the Central Bank of another country in the rate and direction of monetary policy. On the other hand, various technical features of decision-making, such as collegiality in course selection, public reports and open access greatly facilitate the understanding and comprehension by the population of actions that takes the Central Bank in the field of various policies. In this case, the use of foreign experience can be effective.

References

- Official web-site of Switzwerland National Bank: [Electronic Source], http://www.snb.ch

- SNB’s Quarterly Bulletin. Switzwerland National Bank, [Electronic Source], http://www.snb.ch/en/mmr/reference/quartbul_2014_4_komplett/source/quartbul_2014_4_komplett.en.pdf;

- Monetary Policy Assessment of 11 December 2014. Switzwerland National Bank, [Electronic Source], http://www.snb.ch/en/mmr/reference/pre_20141211/source/pre_20141211.en.pdf.