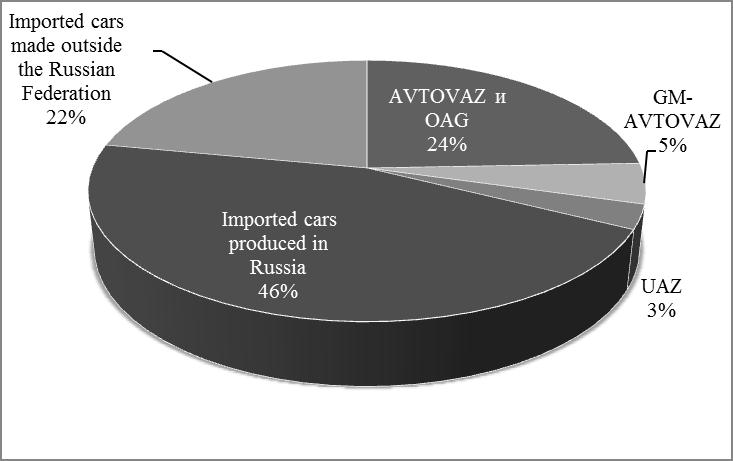

At present PJSC “AvtoVAZ” is the largest enterprise manufacturer of passenger cars in Russia. At the end of 2015 the share of the company for more than 17% of sales of new cars in Russia.

Figure 1 – The structure of the passenger car sales in 2015

Despite this, the financial results of the company leaves much to be desired. So by the end of 2013 a loss of PJSC “AVTOVAZ” has made 3497 mln. Rub., While in 2014 the loss amounted to 5 658 mln. Rub. [1, c.83]. At the same time other manufacturer of domestic cars of JSC “Sollers” received during this period profit of $ 1 786 million. Rubles. and 2 997 million. rubles. respectively. Thus indicators of PJSC “AVTOVAZ” reversed on the background of the success of other companies.

In this regard, a relevant assessment of the financial and economic activity of PJSC “AVTOVAZ” to identify the causes of the situation [2, c.193].

To do this, we carry out the cost-benefit analysis of PJSC “AVTOVAZ”.

Evaluation of the company’s profitability is one of the most important stages of the evaluation.

Especially it is important for the PJSC “AVTOVAZ” experiencing significant financial instability.

Carry out cost-benefit analysis of PJSC “AVTVOAZ” on the basis of public statements.

Carry out an assessment of indicators of profitability of sold products, which characterizes the size of the profits of the enterprise on the ruble investment. Below is the calculation of this index for different periods.

The indicator of profitability of sales in 2011: 3106: 174 846 * 100 = 17.4%.

The indicator of profitability of sales for the year 2012: 211: 145 372 * 100 = 0.145%.

The indicator of profitability of sales for the year 2013: 6899: 175 152 100 * = – 3.93%.

The indicator of profitability of sales for the year 2014: -25 411: 189 370 * 100 = -13.42%.

As can be seen from the above calculations, the most important indicator of the profitability of sales of PJSC “AVTOVAZ” reached in 2011.

Then we spend the calculation of this indicator as a return on assets characterizing the amount of net profit, which falls on a unit of value.

Index return on fixed assets for 2011.: 3106: 58251 * 100 = 5.3321%.

Index return on fixed assets for 2012.: 211: 48877 * 100 = 0.4317%.

Index return on assets for the year 2013: (6899): 56586 * 100 = -12.19206%

Index return on assets for the year 2014: (25 0411) / 78874 * 100 = -32.217%.

As in the previous record, 2011 is more cost-effective in 2013 and 2014 rate reached negative result.

Next, we calculate the index of profitability of the staff, which characterizes the efficiency of work of employees in the establishment of the enterprise. In 2011 this figure amounted to 3 355 106/74 * 100 = 4.17726%. In 2012: 052 211/66 * 100 = 0.31945%. In 2013godu: -6 728 899/66 * 100 = -10.33899% and for the year 2015: (-25,411) / 53 000 * 100 = -479.453%.

From the conducted analysis shows that the profitability of personnel decreased during the period under review. What also characterizes the company negatively.

Return on assets ratio characterizes the profits derived by an enterprise from each ruble advanced to the formation of assets. Below are the values of this indicator.

2011: 3 846 106/132 * 100 = 2.33%;

2012: 211/144 121 * 100 = 0.14%;

2013: (- 6 899) / 149 942 * 100 = -4.6%;

2014: (- 25,411) / 169,254 * 100 = -50.56.

This indicator is also negative, which negatively characterizes the economic activity of the enterprise.

Return on equity characterizes the presence of profit per invested by the owners of the company (shareholders) of the capital.

2011: 3 385 106/32 * 100 = 9.59%;

2012: 211/32 707 * 100 = 0.064%;

2013: (- 6 899) / 25 808 * 100 = -26.73%;

2014: (-25411) / 397 * 100 = -6400.75%.

During the reporting period, there are significant changes in 2013. The return on own index reached negative values, and in 2014 continued to decline.

To assess the efficiency of use of circulating assets will assess their profitability. This indicator shows the profitability of current assets, that is, shows how much profit brings one unit of current assets of the company. In 2011 this figure amounted to: 3106/44890 * 100 = 6.91914%. In 2012: 211/48660 * 100 = 0.43362%. The value of this indicator for the year 2013: -6899 / 45364 * 100 = -15.20809%, and for 2014god: -25411 / 50256 * 100 = -50.563%.

As can be seen from the above calculations of return on current assets also declined, reaching negative values.

Assessing the profitability of current assets, turn to the estimation of such indicator as the profitability of non-current assets. This indicator measures the effectiveness of non-current assets. In 2011, this figure is as follows: 3106/87956 * 100 = 3.53131%, in 2012 its value was: 211/95461 * 100 = 0.22103%. In 2013, the index value was: -6899 / 104578 * 100 = -6.597%, in 2014: -25411 / 118998 * 100 = -21.354%.

During the reporting period, there are significant changes in 2013 there is a negative value, and in 2014, the index continued to decrease further.

In order to assess the profitability of investments PJSC “AvtoVAZ” will assess the ROI of society. This indicator shows the profitability of the enterprise using equity and debt [3, c.149].

This figure was for 2011: 3106/132846 * 100% = 2.33%, for the year 2012: 211/144121 * 100 = 0.15%. In 2013 and 2014 the figure was: -6899 / 1499412 * 100% = -4.62%, in 2014: 25411/397 * 100% = 6,400%.

From the above analysis, it is clear that during the period the return on investment decreased, which is a negative trend.

The results of the analysis show that the highest profitability was achieved PJSC “AvtoVAZ” in 2011, after a decrease in margins which indicates the negative dynamics in the financial and economic activity of the enterprise.

Carry out an assessment of profitability of costs to society. In 2011, the figure was 3 654 476/154 * 100 = 2.25%. For 2012 the value of the indicator has decreased and amounted to 2 820 736/164 * 100 = 1.66%. The value of the index for 2013 and 2014 amounted to 060 -7 975/165 = -4.83% and -26 = 499/192 349 -13.77%.

This indicator shows the return on the cost of production and shows how much the company make a profit from each ruble spent on production and sales. This indicator is also negative, which negatively characterizes the economic activity of the enterprise [4, c.7].

It should be noted that profitability is one of the most important indicators, which is used in the analysis and assessment of financial condition. Profitability ratios, provide a complete reflection of the situation.

The results of the analysis lead to the conclusion that the economic activity of PJSC “AVTOVAZ” a decrease in almost all enterprise profitability, and by 2013, many of the indicators have reached a negative value. The smallest value of the indicators have reached in 2014.

Let us analyze the dynamics of profit “AVTOVAZ” PJSC for the period of 2011-2014 using, as the interim financial statements and annual. It is necessary for a comprehensive assessment of the enterprise.

Table 1 – Analysis of the dynamics of the profit of PJSC “AVTOVAZ”. For 2011-2014

| Indexs | 2011 | 2012 | 2013 | 2014 | Deviation 2012-2011 |

Deviation 2013-2012 |

Deviation 2014-2013 |

| Gross profit

(million rbl.) |

20192 | 18397 | 10092 | 9406 | -1795 | 163205 | 686 |

| Profit (loss) on sales

(million rbl.) |

4659 | 2736 | -6640 | -5658 | -1923 | -8394 | -982 |

| Profit (loss) before tax

(million rbl.) |

3476 | 518 | -7975 | -26499 | -2958 | -27017 | 18524 |

In 2013, there is a significant decrease in the gross profit rate for the following year began to grow. This is a positive indicator for the enterprise. Profit (loss) from sales for the period under review reached a negative value. This negative trend is negative for the company.

This trend is due to many factors. Both external and internal.

it can be concluded on the basis of the above analysis that there is a significant decrease in profit in 2013 and then in 2014. In this period, almost all indicators reflecting the profitability and efficiency of PJSC “AVTOVAZ” reached the minimum, in this period, the value that is a negative trend for the enterprise.

Let us examine the main causes of the current situation, as reflected in the statements of PJSC “AVTOVAZ”.

First, the decline in demand in the Russian market, including because of the situation caused by the sharp deterioration in the macro and micro-economic factors and soaring rates of world currencies.

Secondly, it is the failure of the schedule originally planned to increase production capacity for car production.

Third, it is the growth of the cost of the components caused by the increase in the value of major currencies, which made payments for supplied at PJSC “AVTOVAZ” components.

It can be concluded that many factors affect the profits of PJSC “AVTOVAZ”. To fully identify their conduct factorial analysis is necessary.

Factor analysis – a method used to study the interrelated values of indicators.

With the help of factor analysis can assess the financial and operating activities of the enterprise. On this basis, identify the strengths and weaknesses of the company and based on them to give a reasonable program for the advancement and improvement of the enterprise. Factor analysis is one way to reduce the level of an indicator – the allocation of the entire structure precisely the factors that directly affect the change in the dependent variable.

The most important factor is profit and cost analysis, which allows to identify the factors that affect the operation of the enterprise sometimes negative factors can lead to positive trends, the growth indicators, such as production costs, and thus on the overall performance of the enterprise. And vice versa. That is a particular burden on the index no. The impact of each factor needs to be considered in the context of the enterprise. take into account the important characteristics of the enterprise, take into account whether the company stable.

Also, factor analysis allows to identify concrete and effective measures to improve these indicators and thus the profitability of the whole, and calculate the economic effect of the introduction of these measures.

Factor analysis helps to find the cost of this indicator to determine the implementation of the plan on his level, to determine the degree of influence of factors on its growth, and on this basis, to assess the activities of the enterprise for use of the opportunities and to find ways to reduce the cost of production. On this basis, identify measures for the modernization and improvement of various indicators.

Energy, materials, or labor, must be considered in the context of their impact on the production cost for this and needs factor analysis.

The influence factors on the level change unit cost study using this factor model, according to the formula:

Ci = Fi / Qi + Vi, (1)

where: Ci – unit cost of i-type products;

Fi – fixed costs for the i-th product;

Qi – the volume of production of i-th product;

Vi- variable costs for the i-th product.

The analysis of factors affecting the profits of the enterprise in 2014.

The analysis revealed that in the profits of the enterprise affected by the following factors.

The decline in production had a negative impact on the amount of profits, the negative impact amounted to 16 531.98 million rubles.

The impact factor changes the structure of the products also have a negative impact on the amount of profits. The size of the negative impact of 2 967.02 million rubles.

The increase in average selling prices has increased the volume of received now arrived at 1218 million rubles.

One of the factors that negatively impacted the net profit of the company was the increase in cost of sales reduced revenues of the enterprise profits by 243 mln. Rub. It should be noted that the cost of goods, works or services is one of the most important indicators of economic efficiency of production. The cost includes all key operating side of business, accumulated results of the use of production resources. The level of production costs, unit costs per unit of product will depend financial results, the rate of reproduction and the financial condition of the enterprise [5, c.72].

The cost of commodity products include all expenses of the enterprise for production and sale of commodity products in the context of calculation of expenditure.

The cost price is an indicator that describes the cost-effectiveness of the organization, it is only on this basis can identify factors and reserves and reasonably implement measures at the lowest cost.

Статья подготовлена в рамках работы над исследовательским проектом «К 50-летию ВАЗа: Влияние автомобилизации на социально-экономическое развитие Поволжья», поддержанным грантом Российского гуманитарного научного фонда № 16-12-63003 по результатам регионального конкурса «Волжские земли в истории и культуре России – 2016, Самарская область».

References

- Курилов К.Ю., Курилова А.А. Концепция возникновения экономических циклов // Вектор науки Тольяттинского государственного университета. Серия: Экономика и управление. 2013. № 1 (12). c. 83.

- Курилов К.Ю. Анализ деятельности предприятия с учетом влияния цикличности // Инновационное развитие экономики. 2013. № 6 (17). c. 193.

- Ajupov A.A., Artamonov A.B., Kurilov K.U., Kurilova A.A. Reconomic bases of formation and development of financial engineering in financial innovation // Mediterranean Journal of Social Sciences. 2014. Т. 5. № 24. c. 149.

- Курилов К.Ю. Прогнозы развития мировой автопромышленности // Международный научный журнал. 2011. № 5. c. 7.

- Курилова А.А. Формирование эффективной структуры организации // Карельский научный журнал. 2014. № 3. c. 72.

View this article in Russian

View this article in Russian