Научный руководитель – д.э.н. проф. Ильенкова Н.Д.

Academic Advisor – D.Sc. Ilyenkova N.D.

Today, there are two main areas of company’s operational risk assessment: traditional (operating cycle model, ratio analysis of operational risks; CVP-analysis, factor analysis of profitability) and strategic (models based on construction of a balanced scorecard).

Each of the traditional approach is unique and allows to evaluate the operational risks of a company from different perspectives. Thus, the model of operational cycle allows to procide illustration of the internal processes of a commercial company in the short term. Ratio analysis helps to assess operational risks of a company through financial performance metrics. Break-even analysis determines the zone of positive earnings, in which the company is resistant to changes in revenue. Calculation of operating leverage allows assessing the impact of changes in revenue on earnings. Factor analysis, in turn, helps to analyze the importance of various factors affecting the profit.

Thus, we can conclude that the traditional methods allow to characterize the performance of companies from different sides, so as part of the company’s operational risk assessment it is appropriate to apply these approaches together, not separately.

While the need for traditional models together is quite a reasonable approach, the applicability of modern strategic models for the assessment of operational risks is still under consideration. Of course, with increasing importance of the qualitative characteristics of the company (corporate governance, intellectual capacity of workers) non-financial indicators are playing an increasingly important role. This speaks in favor of the introduction of strategic models of operational risk management.

However, despite the wide coverage of various aspects of the business of a modern company, in general, these models are fairly rare, especially in Russia. This is due to the complexity and ambiguity of the interpretations of the objectives and instruments to achieve them. Of course, for a particular company it makes sense to use only one such model. Therefore, a further comparison of strategic models will be directed at identification of an optimal approach for application to companies operating in Russia.

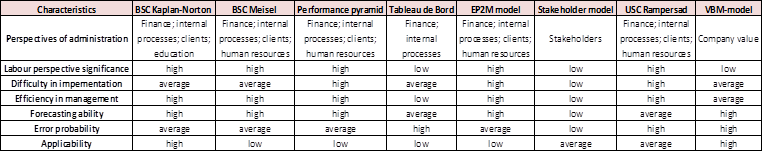

For comparison of models based on the balanced scorecard, the author identified 7 major criteria: “Perspectives” of administration (the control objects in the model); the importance of “perspective” of personnel (staff involvement in the model); the complexity of the implementation and use; the effectiveness of the management (the ability to achieve goals); the ability to predict (assessing the strength of the company); error probability (underestimation of significant factors in the implementation); applicability (the possibility of introducing in real companies). The results of the comparative analysis are presented in table 1.

BSC Kaplan-Norton sees the company from four major perspectives: finance, internal processes, customers and staff training. In this case, the significance of “perspective” staff is high enough since scorecards cover the activities of the company in all its components. The complexity of the implementation and use of the model is average, since indicators are simple and comprehensible and later will be connected with the key objectives and strategy of the company. Efficiency in the management of the use of this approach is high, because the model allows to continuously monitor the activities of the company, identify deviations and make corrections. Predictive power of the model is also high due to the account of different perspectives both financial and non-financial, which are allow to build a forward-looking assessment of the company. However, due to the complexity of identifying cause-and-effect relationships and the correct selection of indicators error probability can be estimated as average. In general, the degree of application of this model is much higher than other models of this kind.

BSC Meisel to some extent is similar to the Kaplan-Norton BSC. The main difference lies in the application of human resource perspective instead of education. In general, as a kind of analogue, this model is used much less frequently.

Performance Pyramid examines the effectiveness of similar to BSC Meisel 4 prospects of the company. In fact, having similar characteristics, it is much more difficult to implement and use, not only because of the difficulty in the selection of indicators, but also due to the need for a serious understanding from the personnel (which forms the bottom of the pyramid), the development strategy of the company. Such a deep perception of HR objectives in practice is quite rare, so the model is characterized by low applicability.

Tableau de Bord sees the company through two main perspectives: finance and internal processes. Staff in this simplified approach is not considered. Therefore, on the one hand the model is simple enough to use, but has a low management capacity. Predictive ability can be estimated as average, but only within the specified prospects with high probability of error due to underestimation of the significant factors. In general, the model is not used practically.

Model EP2M has characteristics in many ways similar to Performance Pyramid. It also examines the same 4 perspectives, introduces the high importance of staff has high complexity in the implementation, effectiveness in the management, predictive power and the average probability of error in the implementation. In general, it is also rarely used.

Stakeholder model sees the company from the perspective of stakeholders, so the role of the staff there is extremely low. The model is not demanding to internal business processes and the quality of personnel, does not use strict regulation and the hierarchy of objectives, therefore, it is easy enough to use with a minimum probability of error, but its management capacity and predictive strength is weak. Nonetheless, the convenience of use makes it attractive enough for application to the efficiency evaluation.

Universal Scorecard of Rampersad examines 4 prospects similar to BSC Kaplan-Norton. The model has a high management capacity and the average predictive power, as it considers indicators which comprehensively reflect the company’s operations. At the same time, it is difficult to use and almost always guarantees the presence of errors in the design parameters. Upon successful implementation, it is quite effective, which makes it attractive when considering alternative models.

Finally, VBM model as well as the Stakeholder model highlights the distinct management objective – the company’s value. Here, a crucial role is given to top managers of the company, without a focus on the staff. The complexity and management capacity model is average: it aggregates accurate financial indicators that define the centers of the value of the company, but it requires high financial expertise. Despite the underestimation of the qualitative characteristics the model has high predictive value, as it allows a sufficiently accurate assessment of the operational risks of the company. However, when using this approach there is a high probability of errors due to manipulation of the top managers with the financial statements. However, today, this approach is widely used.

In general, it is possible to conclude that the strategic models focus on different areas of company performance and have distinct degree of efficiency. Their application allows to identify the factors that affect the financial results and provides management with signals when certain deviations occur. Nevertheless, the choice of a strategic model for a particular company should be attributed to the characteristics and needs of the company.

According to the opinion of a wide range of analysts, BSC Kaplan-Norton is the most applicable model for companies operating in the Russian market due to the extensive coverage of all aspects of the activities of the company, the high management efficiency and an acceptable probability of error. It is important to emphasize, that in a highly volatile economic situation and a high probability of unreliable data in financial statements BSC Kaplan-Norton is the most effective model for the Russian market.

View this article in Russian

View this article in Russian