Nowadays, oil and natural gas are the main sources of energy, and in this century will be a key component of the fuel and energy balances of most countries. Oil exporters countries understand that the export of oil is not the ultimate goal of their own state, and serves as the main base for the development of the economy as a whole. The income from oil exports, as well as self-development of the oil industry, must inform the translational motion of the national economy for the creation of a highly industrialized society.

In this regard, the development of the oil industry should help establish an effective structure of the national economy. In some countries, the development of the oil industry has brought the opposite effect. Venezuela in the past developed agrarian country currently imports of agricultural products as a result of the development of the oil sector of the economy. Norway has substantially reduced fishing due to intensive development of oil fields in the North Sea.

It is well known that oil prices are directly related to the dynamics of global economic growth. A significant decline in prices in a positive way would affect the situation in the economy, but not observed decrease. High prices should encourage producers to increase the volume of oil production in order to obtain additional income [1].

Theoretically, low energy prices (including oil) benefit industrialized countries. The lower energy prices, the cheaper production, higher consumer activity, and ultimately higher economic growth. And as the stock exchange, where the price of oil is formed, it is the institution of the industrialized countries, in the interests of these countries to keep prices at the lowest level, which is only possible using the mechanisms of their own best economic institutions. But, nevertheless, the prices are high. The rise in prices may be considered artificially created when manufacturers deliberately created a supply shortage. Such intentions of producers of oil would go against the interests of developed countries, which would be reflected in the strong reaction of the latter, which is not observed. But if the manufacturers have difficulty with increased supply, then the rise in oil prices is the case of rising prices for scarce goods.

In addition to the global economy, supply and price of oil marketplace generally depend on two factors:

1. Political.

2. Geology.

The political factor is related to aggravate the situation in the Middle East, which is the main oil-producing region. Political instability creates additional risks operating companies, and this risk is laid in the price. The contribution of this factor can be varied over a wide range from a few percent to fold rise in prices. [2]

Geological factors associated with probable reserves and the volume of proven oil reserves, and as a consequence the proposal oil. Throughout the last century geological factor generally not taken into account in pricing since it was believed that oil production will satisfy global demand cheap oil in any amount, and the peak of world oil production issue is very distant future. But at the moment it became clear that it is not, the possibility of world oil production is limited.

In terms of energy supply in China lags behind that of developed countries, so the growth of consumption in China will continue. Moreover, the increase in consumption in developing countries has a much greater potential for growth than the potential decline in consumption in developed countries. Therefore, the full reason for this can not explain the drop in the predicted values of energy consumption of liquid.

If we consider the price of oil in the context of the exhaustion of oil reserves, the higher prices will help to solve a number of tasks aimed at overcoming the shortage of liquid fuel:

1. The reduction in the consumption of liquid fuels.

2. The introduction of energy and fuel-efficient technologies.

3. The development and widespread introduction of tertiary methods of oil production.

4. Involvement in the development of the reserves of heavy and unconventional oil.

5. The development of renewable energy.

The rise in prices associated with the two (equivalent, according to analysts of the IMF) factors:

1. Growth of world GDP.

2. Exhaustion of light oil reserves.

According to the forecast, in the next decade global GDP growth will be about 4% annually, with oil prices in 2021 will reach $ 180 value. / B. It is noted that the current situation is unique, as the global economy has never been a prolonged period of high prices, making it difficult to analyze and identify the relationship of GDP growth and oil prices, and, very likely, at high prices, this relationship is not linear, as now assumed. Price as a marketing tool to solve certain problems.

In the model, analysts from the IMF price solves the problem of supply and demand of oil in terms of global GDP growth. But these macroeconomic indicators and their relationship is largely an abstraction. Objectively, directly to the oil companies themselves the price of oil should solve a very specific task: to ensure the profitability of projects and the development of non-conventional heavy oil. From this point of view it is possible to identify the lower limit of the price of oil, which should be achieved in the next 10 years: the lower limit of the price of oil should be at the level of $ 150. / B. It is this price will provide an opportunity for the development of all areas of production and the production of liquid energy. [3]

Table 1. The dynamics of global energy consumption in the 1980-2009 biennium. and its forecast for 2015-2035 gg., Million tons / day

|

Countries |

1980 y. |

2000 y. |

2009 y. |

2015 y. |

2020 y. |

2030 y. |

2035 y. |

The growth rate of 2009-2035 years, % |

| OECD countries |

4067 |

5292 |

5236 |

5549 |

5575 |

5640 |

5681 |

0,3 |

| Including: | ||||||||

| North America |

2102 |

2695 |

2620 |

2780 |

2787 |

2835 |

2864 |

0,3 |

|

From it the USA |

1802 |

2270 |

2160 |

2285 |

2264 |

2262 |

2265 |

0,2 |

| Europe |

1501 |

1765 |

1766 |

1863 |

1876 |

1890 |

1904 |

0,3 |

| Asia and Oceania |

464 |

832 |

850 |

906 |

912 |

914 |

912 |

0,3 |

| From it Japan |

345 |

519 |

472 |

498 |

490 |

481 |

478 |

0,0 |

| Countries outside the OECD |

2981 |

4475 |

6567 |

8013 |

8818 |

10141 |

10826 |

1,9 |

| Including: | ||||||||

| Европа/Евразия |

1242 |

1001 |

1051 |

1163 |

1211 |

1314 |

1371 |

1,0 |

| From it Russia |

Н.д. |

620 |

648 |

719 |

744 |

799 |

833 |

1,0 |

| Asia |

1066 |

2172 |

3724 |

4761 |

5341 |

6226 |

6711 |

2,3 |

| From it China |

603 |

1108 |

2271 |

3002 |

3345 |

3687 |

3835 |

2,0 |

| India |

208 |

460 |

669 |

810 |

945 |

1256 |

1464 |

3,1 |

| Near East |

114 |

364 |

589 |

705 |

775 |

936 |

1000 |

2,1 |

| Africa |

274 |

505 |

665 |

739 |

790 |

878 |

915 |

1,2 |

| Latin America |

284 |

432 |

538 |

644 |

700 |

787 |

829 |

1,7 |

| From it Brazil |

114 |

185 |

237 |

300 |

336 |

393 |

421 |

2,2 |

| World |

7219 |

10034 |

12132 |

13913 |

14769 |

16206 |

16961 |

1,3 |

| European Union countries |

Н.д. |

1683 |

1654 |

1731 |

1734 |

1724 |

1731 |

0,2 |

Source: Oil Information. 2013. Paris: IEA, 2013. P.81.

According to the International Energy Agency, if in the 2000s the average growth rate of world energy consumption reached 2.5% per year, over the next two decades, the average annual growth trend of energy consumption will be 1.3%, and in the 2020s it has significantly slowed down. Total energy consumption in the world in 2020 is projected at 1.734 billion tons / day (Table. 1)

If the ratio of global supply and demand, depending on the macroeconomic and political factors, as a rule, sets the overall long-term trend in oil prices, the short and medium-term dynamics of the share price today is largely determined by the behavior of participants of the international oil exchange market – a key element in the pricing system world trade “black gold”. Special attention to the formation of oil prices now have action operators of exchange market of oil derivatives, which are established futures quotes on the most liquid, a marker grade (eg, Brent, WTI), used as a guide for establishing export prices for other grades of oil, including the Russian Urals. According to analysts, the market of oil derivatives in recent years turned into an attractive field for financial speculators than is largely due to the explosive nature of the growth of oil prices during certain periods of the 2000s and early 2012, as well as a sharp increase in volatility.

Of key importance in the market of oil derivatives play two groups of participants – hedgers and speculators. The former typically include oil companies and traders who use derivatives as a tool of management (hedging) the risks associated with possible fluctuations in oil prices. Speculation in the oil market are engaged in investment banks, various funds, including index and hedge, as well as other financial investors whose main activity is not related to the production and trade of physical oil. Speculators are working in the market of oil derivatives on the same principles as in the securities markets or currencies, opening position data for the purchase of crude oil in the expectation that prices will rise to it, and short positions if the expected decrease in quotations of “black gold”.

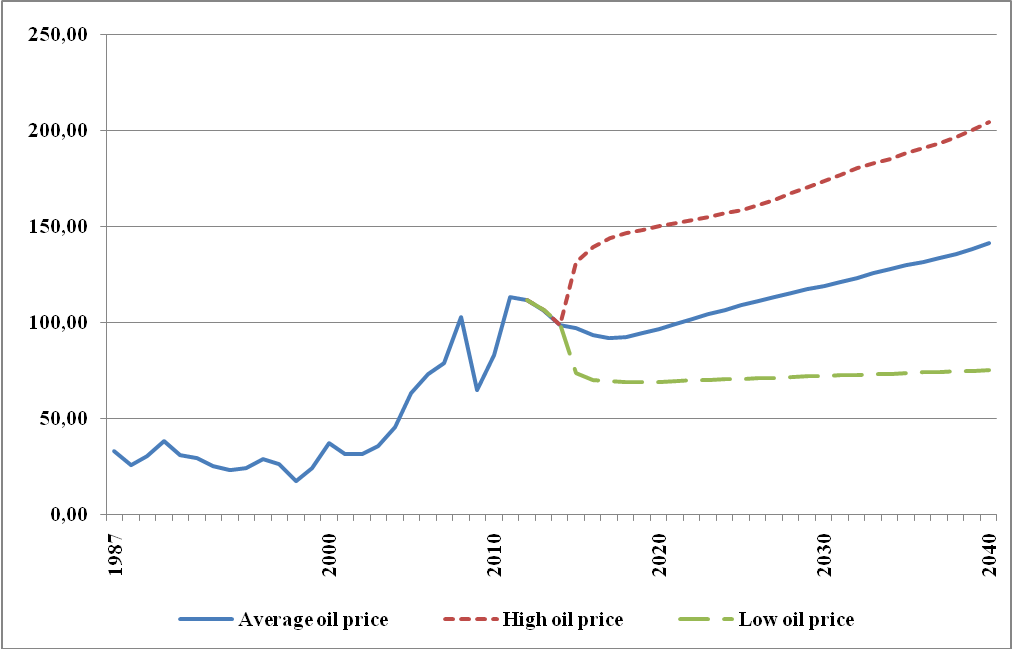

Oil and other liquids production in 2014 from countries outside OPEC, especially in the United States increased to a level higher than in 2013. As a result, OPEC’s market share decline to less than 40% in the near future, before starting to rise again after 2016 decline in price from $ 112 per barrel (bbl) in 2012 to $ 92 / bbl in 2017 (in 2013 dollars), it increases to $ 141 / bbl in 2040 (or about $ 235 / barrel in nominal dollars) and growing demand leads to the development of more expensive resources. However, these resources are not as expensive to develop as predicted in 2013. At lower crude oil prices and reduced demand for gasoline, predicted in 2015 the real end-use price of gasoline in the United States is reduced to $ 3.03 per gallon (2013 dollars) in 2017, then rises to $ 3.90 per gallon in 2040 (compared to $ 4.40 per gallon in 2040 in the AEO2013). End-use price of diesel fuel in the transport sector follows the same pattern, dropping to $ 3.50 per gallon in 2017, and then increases to $ 4.73 per gallon in 2040 (compared to $ 5.03 per gallon in the AEO2013 ). Although both petrol and diesel prices dip modestly in the first years of the forecast period, they steadily increase in the future. Diesel share of total petroleum products on the domestic and other liquids production increased, and the proportion of gasoline falls, mainly as a result of greenhouse gas (GHG) emissions and CAFE standards for LDV, beginning with model year 2017 increasing demand for diesel fuel is putting pressure on processors to increase diesel yields and results in an increasing difference between the price of diesel fuel and gasoline prices from 2017 to 2025. (Fig. 1).

Fig.1. Average oil prices in 1987-2014 years and forecasts the average oil price in the three cases, 1987-2040 years (2013 dollars per barrel)

Source: Energy Information Administration. Independent Statistics and Analysis, 2013. http://www.eia.gov/forecasts/aeo/er/early_prices.cfm

The main competitor of liquid fuel in the field of application is expected to be natural gas, a cleaner source of energy, the use of which is given considerable attention in North America and Western Europe. Great importance is attached and the possible use of coal as the basis for the creation of liquid and gaseous hydrocarbons. Nevertheless, to date the use of natural gas is the most promising.

Oil is becoming a scarce commodity, so oil prices will inevitably rise. The rise in prices will be wearing wavy character. As a result of growth, the lower boundary of the price will be the price, which will ensure the development of all areas of the production of liquid fuels.

In the long term we can say that oil – an asset whose price will gradually decline. Although in absolute terms, the oil price may increase, but the real value will decrease it. In the period 2012-2020 gg. will strongly absorb, despite the considerable financial costs, “unconventional” sources of energy.

Promising economic and social development of the country’s oil producer can be described by the following measures: the effective use of human resources, creation of new jobs, the suppression of inflation, balance the state budget, the decision of some, if not most social problems.

Finally, the government of each country has its own manufacturer tactical political goals: rapid response to the current problems in the development of the oil industry, achieving positive interim results in the development of the oil sector to create a favorable political image.

References

- International Energy Outlook 2011 // Energy Information Administration (EIA). URL: http://www.eia.gov/oiaf/ieo/ (дата обращения 04.09.2012).

- Business: Oil Squeeze // Time, Feb 05, 1979. URL: http://www.time.com/time/magazine/article/0,9171,946222,00.html

- Jaromir Benes, Marcelle Chauvet, Ondra Kamenik, Michael Kumhof, Douglas Laxton, Susanna Mursula and Jack Selody. The Future of Oil: Geology versus, Technology / IMF Working paper. May 2012. http://www.imf.org/external/pubs/ft/wp/2012/wp12109.pdf

- Energy Information Administration. Independent Statistics and Analysis, 2013. http://www.eia.gov/forecasts/aeo/er/early_prices.cfm

View this article in Russian

View this article in Russian