It should be noted is that in the early 21st century, Russia lagged far behind many European countries on such an important indicator as the penetration of mobile communications [1, c.9]. However, over the next eight years, Russia has managed to bridge the gap and reach a sufficiently high level of development of mobile communication. Thus, in 2005-2006, the growth in this segment was the most noticeable, thanks to a sharp increase in the level of penetration in the market and increase sales of sim-cards [2, c.84]. At the same time, the mobile phones have become more accessible due to the competition among telecommunications companies, a wide coverage and low prices for the services. In addition, since 2006, it began to grow indicator of ARPU (revenue per subscriber of the operator) in the telecommunications industry of the Russian Federation. However, the index MOU (the number of minutes per subscriber) decreased until 2007. Then, after 2007 3Gseti began to spread in Russia, which resulted in sustained growth industry revenues, primarily due to triple-play services (Internet, television, mobile communications). This statistics shows that the share of mobile communication among all services in the telecommunications sector, are still high and is about 40% [3, c.392].

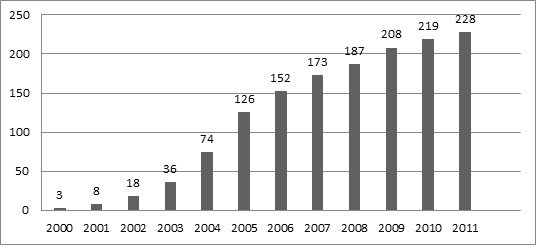

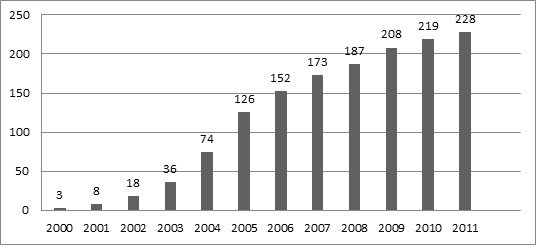

The telecommunications sector in recent years is quite large within the Russian economy. So, in the words of the Racha in his article “The spread of mobile communications in Russia” in 2008, the sector accounted for 1.5% of GDP. At the end of 2014, the sector of transport and communications accounted for about 9% of the GDP of the Russian Federation [4, c.236]. It may be noted that the growth rate of the telecommunications industry is closely correlated with the rate of economic growth in recent years. Furthermore, the number of subscribers and users of the Internet is growing steadily, and large companies financial performance are improved. The rapidity of development of mobile communications in Russia is confirmed in Figure 1. It shows that from 2000 to 2011. the number of subscribers increased by about 80 times [5, c.36].

Figure 1 – Dynamics of the number of Russian mobile subscribers (million subscribers.)

If we consider the state of the Russian telecommunications market in more detail, it is necessary, first of all, a lot of companies to structure by providing the following 4 types: all-Russian operator, inter-regional operators, regional operators, virtual operators [6, c.57].

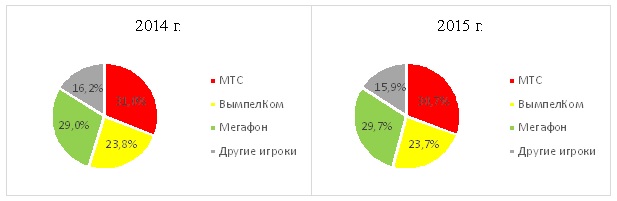

All-Russian operators are represented by three major companies. They are called “Big Three”. Together, they occupy about 80% of the Russian market. This is the company “MTS”, “Vympelcom” and “Megaphone”. The total subscriber base of these enterprises in Russia is more than 200 million. Man. Own a cellular network in all regions of the Russian Federation – as their hallmark. These facts are confirmed in the diagrams below. Here you can see the leadership of the three listed companies in the industry (in the mobile market) in 2012, two important indicators – revenue and number of subscribers.

Now we tell you about these companies and give them a brief description. PJSC “VimpelCom” is a group of “VimpelCom Ltd” company, which is one of the largest integrated telecom operator. Among the countries of presence of the operator can be identified, countries such as Russia, Italy, Ukraine, Kazakhstan, Uzbekistan, Armenia, Georgia and many others. The company’s subscriber base is represented by 54 million. Subscribers. PJSC “VempelKom” offers mobile services, fixed-line, using both wired and wireless technologies, including Wi-Fi, optical fiber access and 3G / 4G network. It should be noted that for a long time, the company had problems with a high cost tariff plans, which it subsequently revised. In addition, elements of communication were improved communication with customers. The main vector of the strategy of PJSC “VimpelCom” at the moment is the widespread transition to digital (digital standards) [7, c.95].

PJSC “Megaphone” can be described as one of the leading Russian telecommunication companies. The company operates in all segments of the telecommunications market of Russia. The number of subscribers of “Megaphone” is approaching 70 million. Man. Also it should be noted that the “Megaphone” is presented on the entire territory of Russia, in the Republic of South Ossetia, Abkhazia and Tajikistan. In addition, well-known company Yotayavlyaetsya subsidiary of the company in question. In this regard, the system of data transmission in PJSC “Megaphone” developed to a high degree and is one of the main advantages of the company in the telecommunications market of the Russian Federation [8, c.536]. Thus, the main prospects and current position “MegaFon” is largely dependent on the mobile Internet.

PJSC “MTS” is the largest company in the Russian telecommunications sector. The subscriber base of the organization is almost 80 million subscribers. “MTS” provides services in Russia and in some CIS countries: Belarus, Ukraine, Uzbekistan, Armenia and Turkmenistan. The company is engaged in mobile and fixed communication services, as well as cable TV. In addition, the MTS brand is the most common and expensive in the world among Russian telecom companies. It is estimated at about 200 billion rubles. The policy of “MTS” in the long term requires the promotion of a variety of complex sentences and saving the existing subscriber base.

Kmezhregionalnym operators are companies that provide their services only in some regions of Russia. This, above all, PJSC “Rostelecom” and “Tele2-Russia”. The number of subscribers in these companies, in contrast to the all-Russian a few million people. However, they significantly compete with companies from the “Big Three” in the regions.

At the regional operators in Russia has usually a small subscriber base of several tens or hundreds of thousands of people, incomparable in terms of subscribers with the views of telecommunications companies discussed above. In addition, these operators has been largely absorbed by the major players in the market.

Also, there are also virtual operators. These companies usually use the infrastructure of other operators, but at the same time offering their services under its own brand. Virtual operators are not in direct competition with the classical, as they do not occupy important positions in large companies rynke.Posle study of various types of companies represented in the Russian telecom industry, let us consider some of its specific features.

Firstly, the telecommunication market in Russia is oligopolistic. So on it represented the three major companies that occupy a large part of the market, and a number of much smaller companies. The telecommunications industry in Russia is highly concentrated. In this regard, a common phenomenon – the regulation of state companies. This fact is manifested, for example, in the regulation of roaming tariffs, which negatively affects the development of the cellular market in Russia.

In Figure 2, one can observe the distribution of market shares of the main companies of telecommunications industry in Russia in terms of number of subscribers. Thus, it is obvious that the structure is preserved since 2012 (Figure 1), “MTS” holds the leading position, and “VimpelCom” is on the 3rd place. At the same time, we note that in 2014-2015, from the “big three” backlog small telecommunications companies declined. So in 2014 and 2015 the share of the “Big Three” in the index of the number of subscribers was 83.8% and 84.1% respectively against 82.3% in 2012.

Figure 2 – The structure of the telecommunications industry in the number of subscribers in 2014-2015. (%)

The same situation is observed with the index of revenue in the industry. However, one difference can be seen – “VimpelCom” significant lags in 2014-2015, than in 2012, and “MTS” has strengthened its leadership.

Secondly, the telecommunications companies in Russia have significant potential for development. For example, in a cellular area can be identified transition to 4G communication means. Changes in communication technology is due to the needs of society in the transmission of large amounts of information with the highest possible speed.

It should be noted that data services in 2015 remained the fastest growing segment of the mobile market in Russia. During this (2015) year of the Russian market of mobile data has grown by almost 20% (to $ 210 billion. Rub.). In addition, the share of mobile data in the total revenue from the wireless communications has increased from 20% to 23.7% for the period 2014-2015. The main factors growth of the market began to increase penetration of devices that support the transfer of data, the above 3Gi 4G development, as well as the prevalence of “heavy” content.

And, thirdly, a number of characteristic Russian telecommunications market features can be extended features such as vast areas of the country’s dependence on foreign equipment and rather big population. These characteristics should be considered in conjunction with some other problems affecting the development of the telecommunications sector in our country.

These problems are especially: “permanent flow of disloyal customers from one service provider to another” error in calculating the number of subscribers and customers, declines in ARPU (averagerevenueperuser) and the imperfection of the legislation relating to communications. If we talk about the first issue from the list, then, first of all, it should be noted that it is usually manifested during any operator and advertising campaigns, such as tariff reductions for certain services. According to the research of various analytical agencies, roughly 20% of subscribers are often inclined to change operator. Most of these customers are not loyal, although some may at the same time to use the services of different telecommunication companies.

Due to the instability of said subscriber database is a different, previously isolated problem. It lies in the discrepancy in the counting of the number of clients. In the past no longer as relevant a few years this problem, since differences account for approximately 10-15% versus 40%, which had been previously. However, do not take it into account in the analysis of the telecommunications industry in Russia is impossible. Now a few words about the negative consequences of this problem.

So differences in the number of inactive subscribers, and actual results in errors in the calculation of subscriber bases. This significantly affects the economic performance of the telecommunications operator, as one of the most important indicators of its activity is the average revenue per user per month (ARPU – averagerevenueperuser). In our country, this figure is quite small and around $ 10 per month. However, in Western Europe, it is more than $ 15 per month. Thus, it turns out that inflated the number of subscribers reduces the average revenue on the client due to non-active service users.

Nevertheless, the most significant obstacle to the development of RF telecommunications market are various disadvantages legislation with respect to communication. In this regard, it is important to note first of all the absence of the concept of “technological neutrality of the frequency spectrum.” There is growing linkages between IT-industry and telecommunications industry. Therefore, operators tend to their networks to ensure the availability of modern telecommunications services. But keep in mind that “the law operator has no right to use their frequency resource released in case of failure of the old communication standard.” Therefore, for the regional operators have problems, leading to difficulties in the transition to new, modern standards, and to reduce their ability to compete with large companies. This fact hinders the development of the telecommunications industry in our country. In addition, in connection with the circumstance falls the level of competition and there is a technological gap small companies to large.

Turning to another issue of the telecommunications industry, observed in recent years. This market of traditional voice communication. Being the largest mobile market, it is characterized by a steady decline in revenue. This trend is primarily manifested on the background of the popularity of 3G and 4G networks and OTT-content. Thus, there is a shift from voice services to data transmission. The operators seek to maintain the demand for voice communication services using the developed rates are aimed primarily at increasing voice traffic. Earlier in this paper were shown features of the dynamics of revenue from the two elements of the mobile market – voice and data services. Now let us turn to the last component of the studied market – VAS-services (high value-added services).

Market VAS-services in Russia is developing steadily and maintains a certain level of revenue. Among these services, you can select content services, short messages, e-commerce. In addition, it should be noted various media content and mobile TV, whose popularity is gaining momentum in recent years.

Consider the features of the mobile segment, we turn to the study of the fixed-line market. Dynamics of fixed communication is stable, as is the case with mobile svyazyu.Pri that, despite the decline in revenue in 2014 due to the failure of many customers from fixed telephony, achieving in 2015 blocked the previous losses. So, in 2015, promoted by telecommunications companies additional options for government and corporate clients.

In addition, it is necessary to note the trend in the market of broadband Internet access. Firstly, there is a saturation of this segment, especially in large cities. Second, competition from wireless technologies is reflected in the reduction of the rate of construction of fixed-line infrastructure. This leads to a gradual reduction in the rate of revenue growth in this segment.

Turning to the last segment of the fixed-line market – pay-TV, it is worth emphasizing its positive outlook. The volume of this segment grew by nearly 12% over the past year. The level of penetration of pay-TV is currently not reached the level of 100%. Also active dissemination of digital TV (60% of all connections) allows companies to increase the subscriber base. So, having considered the two main market telecommunications industry – mobile and fixed network, we turn to the last important element – Sales of equipment.

Sales in the telecommunications sector can be divided into four categories in recent years: smartphones, tablets, PHABLET (smartphones with a diagonal of 5 inches) and modems. In 2015 there was a decline in sales of smartphones, due to unfavorable economic conditions and falling incomes. However, prices for this category of equipment sales market grew. Thus, sales of smartphones in the ruble has declined in 2015. If you pay attention to the implementation of the tablets, it is necessary to note an even greater decline in sales. In addition, in the case of tablets, the average price decreased, which negatively affected the revenues in this segment. PHABLET situation, on the contrary, was the engine of sales in 2015. Sales in this market grow in proportion to the increase in popularity of mobile content and the desire of buyers to replace the tablet phone with enough big diagonal, thereby optimizing costs. Proceeds from the sale of PHABLET increased by 63%, while the average unit price has not changed in comparison with previous years, and still refers to the average price segment. Considering the sale of modems and routers, we note that they are invariably reduced the last few years. The main reasons for this lie in the prevalence of smartphones, tablets and other gadgets that do not require installation of a separate equipment to connect to the Internet. In addition, the fall of the market of notebooks has led to lower revenue from sales of USB-modems.

References

- Артемьев А. В. Оценка динамики и структуры финансовых результатов ОАО «АВТОВАЗ»//Азимут научных исследований: экономика и управление. 2014. № 3. С. 7-10.

- Мальцев А. Г., Мальцева Т. А. Оценка ре-зультатов деятельности ОАО «АВТОВАЗ» В 2013 ГОДУ//Карельский научный журнал. 2014. № 3. С. 83-87.

- Ярыгин А. Н., Колачева Н. В., Палфёрова С. Ш. Методы нахождения оптимального решения экономических задач многокритериальной оптимизации//Вектор науки Тольяттинского государственного университета. 2013. № 1 (23). С. 388-393.

- Колачева Н. В., Палферова С. Ш. Относи-тельные статистические показатели стохастических моделей//Известия Самарского научного центра Российской академии наук. 2006. № S2-2. С. 234-237.

- Иванов Д. Ю. Прикладная модель системы материального стимулирования (на примере предприятия специального машиностроения)//Проблемы управления. 2010. № 6. С. 33-37.

- Иванов Д. Ю. Экономико-математическая модель системы материального стимулирования работников предприятия специального машино-строения//Вестник Самарского государственного аэрокосмического университета им. академика С. П. Королёва (национального исследовательского университета). 2010. № 3. С. 54-62.

- Иванов Д.Ю. Модель анализа и прогнозирования динамики промышленного производства и ракетно-космической отрасли российской федерации // Актуальные проблемы экономики и права. 2016. Т. 10. № 2 (38). С. 93-101.

- Засканов В.Г., Иванов Д.Ю. Методологические аспекты повышения эффективности организации процессов проектирования, производства и эксплуатации авиационных изделий // Известия Самарского научного центра Российской академии наук. 2015. Т. 17. № 6-2. С. 535-539.

Все статьи автора «Курилов Кирилл Юрьевич»