According to the opinion of the author of this paper, financial analysis of business systems today may not be sufficient without market research. A firm may have a perfect even an ideal competitive financial performance (for a time of calm before the ‘storm”), an ideal innovative technology, staff, clientele, PR, …., But, while at the same time be bankrupt … … or almost bankrupt … .. or go to the huge multi-million or even billions of dollars in damages … ..

The modern world is littered with such examples. Polaroid had a unique advanced technology, perfect financial performance, many orders, excellent staff, and the image of the world-known-brand…. quickly, in just an half a year, it came away from the market. Mercedes is perfectly competitive company, including the time, when it was close to be bankrupt. Toyota finished 2009 with a multimillion-dollar losses (we do not take the real-time situation, when these losses are primary caused by the recent earthquakes, that got started from March 2011 and are not yet ended by the end of 2011), although it was and it is an ideal company in terms of financial analysis (a year before 2009 and 2011 the financial analysis wouldn’t reveal clearly the trends of 2009 and 2011). Stern Holdings, the world advanced construction mega-corporations from the past with the state estimated in billions of dollars at more than an half a year before its financial bankruptcy, had an ideal financial performance: a phenomenal growth. Such examples in the modern world can be found among a large number of business-subjects among practically all the economic sectors: agriculture, petroleum, metals, automotive, construction, textiles, wholesale and retail trade, socio-cultural service (hospitality) and tourism and so on ….

And so it was not only in the 20th and 21st century, and even much earlier. And then the bankrupt companies could be found virtually in all the industries. For example, there were no bad trends vivid evidences even two weeks prior to the John Layter’s financial corporation’s bankruptcy; the corporation which was led by John Layter in the late 19th century in the United States, and it was a corporation which had tens of millions of dollars of liquid assets (at that time it was a tremendous amount) and a lot of expensive goods for resale …. and, just in two weeks, the situation has changed so that the company went bankrupt in no time …! It cannot be so easy in a modern economy just to take a company and to conduct its financial analysis in isolation from the marketing segmentation.

In Russia, it is important to know such a feature – that the segmentation should be exactly of Russian actual market! That is why the market analysis should be a kind of ‘safety cushion” of the overall financial analysis. It is the analysis that should timely identify prospects for certain industry, for certain market and for certain company in their existence and to dete RMI ne the prospects for a firm within a particular market segment. Let’s examine the domestic market during the period from 2000 to 2010. If we consider the main sectors of the economy as a whole, we can draw the following conclusions regarding the main trends of development. Peak Development came in the 2000 – 2008 years for virtually all sectors of the economy, while the largest economy growth was from July 2003 to August 2008.

The growth was so rapid that it was almost the time when there were very few non-profitable sectors. Even traditionally crisis agriculture industry and the textile industry (which “fights” for decades now with China for a market share) were aligned to bring stable income. Of course, the forefront of the economy now and then, incidentally, was the fuel-energy complex in the sections of fossil-fuel-flowing (FEC-1) and processing of fossil fuels (FEC-2 ). The main sectors in the domestic economy are agriculture (A/C ); fuel and energy sector / part of: fossil-fuel-flowing / (FEC-1); fuel and energy sector / part of: processing (refining) of fossil fuels / (FEC-2 ); resources mining industry / part: with the exception of fossil fuels (FEC-1) / ( RMI ); food, tobacco and alcohol processing, products (FTAP ); textiles (TEX); woodworking and wood processing industry (WWP ); pulp and paper production, publishing and printing (PPPPP); metallurgical complex with all the ancillary industries (MET); automobile industry (Auto); construction (CON); wholesale trade except for wholesale trade of motor vehicles (WST ); retail trade except for retail trade of motor vehicles (RetT); socio-cultural-service-and-tourism /Russian for: hotel industry, restaurants and other food industry establishments, entertainment and hospitality, tourism, entertainment and organization of such activities / (HOSP); real estate / real estate transactions, leasing and other services related to Real Estate / (RE); education industry / kindergartens, schools, technical schools and colleges, institutes, academies, universities, research institutes and similar organizations / (EDU); service industries, including utilities and except for financial services (SER).

It is clear from the above mentioned material that the domestic economy is very diverse in areas of activity. For ease of reading, the author will use the abbreviations listed in parentheses for each sector of the economy to avoid a repetition, sometimes, of quite lengthy descriptions and definitions, you, dear reader, in turn, should realize that the definition and interpretation of the general concepts are presented earlier. Let us return now to the marketing segmentation. How you do, dear reader, remember that the domestic economy grew until August 2008. If we take and analyze the data of tax accounting of all these industries, we shall be able to identify the relative weight of each industry over the past nearly 10 years in terms of the total tax base. As you, dear reader, remember, the tax is levied on the so-called taxable income, adjusted in accordance with the tax accounting (not all costs can be attributed to the lowering of the tax base, as you, dear reader, remember). The average industries” efficiency has the following manner, according to tax returns for the period, grouped to the structure of industries:

Scheme: Average structure of the total value of the tax base by sector from 2000 to 2010

![Scheme: Average structure of the total value of the tax base by sector from 2000 to 2010 [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/s1.jpg)

The above graph shows that the country’s tax base are Fuel-Energy-Complex (FEC) and metals, which together account for 47%, and if we add to them 4% of DPI, we find that these areas of the economy worth 51% of taxable income over the last decade. Along with them, the growth in property prices over the last decade led to the level of advanced yet another industry – real estate, which developed in Russia in a specific way even during the crisis times: the prices for property in Russia decreased little during the crisis beginning, and, after it, began to rise again.

Rent, maintenance transactions and transactions in the secondary housing market has become so profitable that it can compete even with the domestic steel industry in terms of taxable income. The industry that should be estimated apart – is the wholesale trade industry, which covers up to 25 times the volume of retail trade at the specified index. The wholesale trade industry as a whole can compete with oil. The recent crisis in the construction business, along with an increase in yield of major agricultural corporations, virtually leveled the two sectors forward in terms of profitability, which take a pride place number 8 and 9 in terms of taxable income.

Moreover, agriculture – this is only a part of the agro-industrial-complex (AIC), which expands its influence in the sector of food production, which puts agriculture at one level to the sectors of mining, construction and other industries, surpassing the volume of retail sales at times. In fact, agriculture ranks 6th on the amount of the tax base in the country, which, considering that the first three places are occupied by oil and metallurgical complex, is an excellent indicator for the “former industry-in-crisis”, which had lost much in the 1990s, and today has become a powerful basis for the whole economy, because some agricultural companies received strong shocks to development.

However, as it may seem paradoxical, there is no fully rational reason for the domestic market segmentation based upon objective indicators of the tax base of companies. There are some practices that are widely applied in Russia like financial statements” optimization transformations in order to minimize the tax base itself in various ways that in itself distorts the above concept. Second, there are a number of factors that argue in favor the concept of the idea to apply some additional indicators in the overall analysis of the market. In particular, let us work together with you, dear reader, and look at the following schedule: Graph: Histogram of the structural changes of industries in terms of a structural shift of the tax base on data from 2003 and 2010

![Graph: Histogram of the structural changes of industries in terms of a structural shift of the tax base on data from 2003 and 2010 [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/s2.jpg)

That Histogram shows that the oil sector confidently pulls the structure of the economy in its favor, roughly, just over 2.6% annually. Among non-oil sectors of advanced triple, which gradually “pulls a structural blanket” of the economy on itself, the attention should be allocated in a wholesale trade, A/C and retail trade. These three sectors of the economy pull structural “a structural blanket” with trends substantially lower than oil – about 0.75% per year in total. The mentioned above trend pulling is connected with the fall of the structural weight of the metallurgical complex at 1.75% per annum, and with the fall of automotive, real estate, PPPPP industries. Investments that are in these sectors – they are gradually going to fund more successful in economic terms sectors. Other industries are also losing structural weight, together with this, this process is very slow.

Before we, together with you, my dear reader, shall consider the segmentation of the modern Russian market, we should make a slight digression, for how market segmentation was carried out earlier…. in the past…. Conventionally, in the history of the domestic market segmentation, there can be divided two phases: the Soviet market period and a new market stage. In the Soviet Union they conducted market segmentation by means of specialized institutions of the economy (the so-called NIIs - National-scientific Investigation Institutes), which led the development of production plans (the most kinds of plans were the so called 5-year plans (the term came to the then science from the Russian then slang: “Pyatiletka”)). Then there was only one model of market segmentation: with a focus on opportunity cost (more precisely, an imputed opportunity cost). Then the NIIs analyzed the isolated multiple-components-cost-structure, which was based on planning.

The basis of the cost was the cost of the so-called production cost at department, which consisted of material costs, which were subtracted from the return waste (raw materials, which should then be proceeded by the re-processing procedures, such as sawdust in the wood industry). Next, they added the value of labor costs of production workers, depreciation and maintenance of fixed assets (in accordance with regulations) and other costs. If we detailed the cost structure, we would receive the following costs: raw materials, purchased components, intermediate products, services, recurrent wastes (subtracted), fuel and energy for the technical and technological goals, the basic wage of production workers with additional charges and social contributions, the cost of training for production and development of production, costs of maintenance and operation of equipment and other expenses. The result of this sum is the full so called in-department cost of production, which then was added to overhead expenses and loss of spoilage, as well as certain other expenses.

The result of this extra-adding would be the production cost, which then was adjusted to the amount of so-called non-productive costs to get the full cost. Then this cost was divided by the estimated output; the resulting figure was the total unit cost. Now the process of cost calculation is similar inside many of the nowadays Russian enterprises. The difference between the old and new methods to calculate unit cost is in the fact, that earlier, in the USSR, they estimated total imputed cost of a kind, that is, the standard unit cost for companies within the industry. Sale price was also normalized. The New Market was opened after the transition to a market economy; the segmentation of this New Market was a term nobody thought about. Instead of this, companies, usually, used a simple calculation model: cost + standard of profitability, which can be expressed in the following formula (1):

![]()

There was also a scientific and a rarely used in practice model to dete RMI ne the optimal price of the goods. It was associated with so-called variable costs. In summary it can be expressed as follows (2):

![]()

Where: Price - is the final unit price; Cost full at production item unit - is the full cost per unit of output, it is the full amount of the unit cost of production; PROFITABILITY RATE cost full at item unit - this is desirable or estimated value of the profitability of the unit cost of production; Cost variable at production item unit - is the sum of variable costs calculated per unit of output; PROFITABILITY RATE cost variable at item unit - this is desirable or estimated value of the profitability of the unit’s variable costs of production

That is how the price was dictated then. Segmentation was not a thing to be performed, because everything then was literally swept away from the shop and market shelves, and that is why there was no necessity to take competitors into an account. With the advent of market economy, the market began to saturate gradually. Then, gradually became more popular following type of calculation of the total price of the product (3):

![With the advent of market economy, the market began to saturate gradually. Then, gradually became more popular following type of calculation of the total price of the product (3) [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/f3.jpg)

Where: COST FULL - is the full unit cost. Thus the total cost of production was calculated then. In the same manner it was calculated the amount of income that the entrepreneur would like to earn over a certain period (eg one year). In corresponding to this the sales volume and price were calculated at the volume enough to receive a specified rate of income.

While, many companies didn’t think then about the pricing policy, and they worked in the “old fashioned way”. Gradually, the market economy had increasingly been becoming to dictate its strict conditions. Competition tightened. Many companies began to leave market en masse because of their lack of market efficiency. Much has changed since those years. Unfortunately, however, the internal policies of many local companies aren’t still built on the definition of market segmentation, market share, its sales volume, issues of the market adequacy of its activities, and dete RMI nation of the optimal price for a commodity. Most of these companies are gradually leaving the market, donating their position to more successful in the marketing and financial management spheres competitors.

Optimal commodity price for a company, unfortunately, is not the same as the company’s position in the market segment; of course, if it wasn’t be so, it would easier much the life of analysts around the world! Position in the market – is synonymous with the market segmentation. These terms relate between each other as follows. To dete RMI ne the position at the market, companies need to divide it into segments. The largest segments are the supra-national economies, such as Eurasian economic system that is different, say, from North American. Then there come the country segments, multiregional, regional, and so on. Along with this, there are many other market segments. For example, manufacturing, wholesale trade, education, agriculture and so on, each of which has its specific features. Segmentation of the market can go up to infinitesimal micro-segments….

Moreover, successful companies, usually, often developed themselves in the neglected segments. Thus, segments of cars for everyone; computers for each person; TVs for everyone,…. – All of these segments for a certain time were ignored by everyone, however, until the first successful companies pioneered in them …. Therefore, the cluster analysis is used mostly in the west for the qualitative dete RMI nation of the structure of segments, which, at the same time, is one of the most expensive types and market analysis. The author of this paper has developed for you, dear reader, the analogy of the cluster model analysis in order to apply it to everything and everyone, in this case, the calculations and comparisons conducted by individually you, dear reader, would be not so expensive with the minimum discrepancies from the information that could be obtained by using a much more expensive cluster analysis.

The author of this paper provides a convenient model to estimate and dete RMI ne the position and the company’s market share at the market segment, that will slightly open knowledge of how successful a particular company is in a given market segment. Now, when we get a glimpse into the domestic economy and the problem of segmenting the market, let’s move on to the actual segmentation of the domestic market. The author of this paper (this is me) has developed his own model to comprehensively and successfully segment the domestic market for companies. The technique can be schematically represented as follows:

Scheme: the Alexander Shemetev’s method: company’s segmentation at market

![Scheme: the Alexander Shemetev’s method: company’s segmentation at market [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/s3.jpg)

This scheme is necessary to be commented. Alas, all companies in the market can be divided into two major categories: solvent and insolvent. It is clear that the segmentation of the market in a state of crisis is very different from the normal segmentation of a successful business system. According to the concept of the founder of the social and ethical marketing, Ph. Kotler (Ph. Kotler, 2008), the company positioning at the market can be reduced to three core strategies, following which a company can succeed, and, on the other hand, if the company will adhere to more than one strategy at once – it is highly likely the company to leave the market. These strategies are: cost leadership (calculated at minimum cost, price and simultaneously selling the maximum volume possible), the leadership in positioning (positioning of the goods – it’s positioning by fashion, quality, design, geographical location, additional services, packaging and so on / sometimes this strategy is called as differentiation/), leadership at a narrow segment (for example, the production of sponges for industrial climbers, skateboards, scuba diving equipment, software for weather stations and so on). In the case of leadership at a very narrow segment a company can combine both cost leadership strategy and leadership on positioning strategy.

Thus, there are four types of market positions for each company at the market: three for successful companies and one for the unsuccessful. Each type of business system has its own unique set of models. Let’s start with the introduction of stable and successful companies, and with the strategy of cost leadership. The strategy of cost leadership involves ensuring minimum cost product for maximum sales. This strategy is particularly important specified for the Russian economy, because the companies which are concentrated at this strategy provide much of the revenue to the country’s treasury. This strategy is pursued by the majority of fuel and energy complex FEC-1 and FEC-2 companies, a significant portion of steel companies, as like as mining, and agriculture companies.

The total volume of these companies in the mass of the taxable profit estimated on its average value, during the period from 2000 to 2010, is more than 51.5%, which is extremely important to the economy. In this strategy, there is a certain standard of finished product for mass production (steel products, gasoline AI-92, crude oil grade Urals, the grain of the highest category and so on) to which these companies must continually reduce costs in all possible forces to remain competitive.

Because of this these companies are suitable for the two models which are developed by me for the segmentation of the market: mono-parametrical and segmentary model, which should be used in tandem, which means: together. Let’s look at them closely. Alexander Shemetev’s model: the mono-parametrical segmentation model of the Russian company at the market For companies which follow this strategy the two mono-parametrical models should be calculated: cost-oriented and focused on the variations in quality indicators. We should distinguish between themselves both the model to assess the feasibility of introducing a new product to the company and the model of proper segmentation at the market. The price of a new product introduction for such companies is:

![]() (4)

(4)

Where: P(NP) - is the total price of a new product; P(UP) - is the total price of the underlying product; I(NP) - is a measure of the increment of the main technical parameters, which are significant for the product, and which should be expressed in a multiplicative terms. Multiplicative expression of common percentage (MEC) is estimated by a simple formula:

![]() (5)

(5)

Where: P (%) - is the percentage of increased, in comparison with the base product, new product main parameter for evaluating the feasibility of its implementation. For example, if the introduction of a new product increases the key parameter of the underlying product to grow by 25%, the value of the MEC is 1.25 (125%).

However, this does not mean that all products should be introduced, whose P(NP) will be maximum, as well as the set I(NP) parameter. It should be remembered that the basis for the development strategy of this type for companies should be:

![]() (6)

(6)

That is, the minimization of costs in all possible ways. If a new product is, in prospect, as much as a product for mass production at minimum cost (eg, fuel ethanol); – then these companies should make sense to consider the effectiveness of its implementation. This simple model allows to describe the pattern of companies of this type. Now, let’s go straight to market segmentation. The author of this paper developed a model for the segmentation of the market for this type of business systems for the major sectors of the economy where there are large quantities of this type of firms.

The model is based on the industry average cost segmental matrix system, which is verified by the author based on data from all the 100% of Russian companies’ main branches of the presence of leadership strategies on costs in the period from 2003 to 2010 (the end of 2010 is taken analytically). The matrix is set out below: Table: Segmental matrix system industry average cost

![Table: Segmental matrix system of industry average cost [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/t1.jpg)

The above matrix shows how many rubles and kopecks of each type of expenditure (expressed in thousands of rubles) are accounted for each thousand rubles of revenue of companies in the industry / for example, the 0.67128 for the cost in the A/Ccompanies mean that the 01 thousand (1,000) rubles 00 kopecks of revenue, on average in the industry, have 671 rubles and 28 kopecks of the total cost of production /. The only reservation should be done in service industries: there the greatest basis exists for the application of optimization transformations of financial reporting. The value of industry average costs by cost components for individual companies within the industry is calculated as follows:

![]() (7)

(7)

Where: β - is the coefficient of the position cost (eg, total costs or material costs), which was taken from the matrix for the industry in which the company operates and applies the cost leadership strategy. Rev - is the amount of revenue produced by company, which is then subdivided within the different elements; the revenue is then transformed into thousand rubles by the Kindex / everything is transferred into proceeds, because the cost is expressed in terms of revenue in the matrix system /.

K - is the conversion coefficient of revenue to thousands of rubles, which is calculated by the formula:

![]() (8)

(8)

Where: UM - is a unit measure of the currency in which your company is accountable (if thousands of rubles, then the UM index is 1,000, when millions of rubles, then 1,000,000). In the same way as it is performed for costs in formula (7), it is necessary to perform the calculations for the smaller components of costs like MC, SAS, OTA and so on, as it is performed in the example of calculations below.

The average industry structure of the Subject Company can be estimated with these figures, the figures with which one should compare your own or other legal entity under an analysis. If it is so that in your or another one company there is a situation when the costs of company under an analysis are higher than in average for this sector – it means the corporation under an analysis follows outside the costs leadership strategy and, therefore, it is a candidate to be rid of in a selected industry.

If it is so that the company under an analysis has the costs indicators lower the average in an industry, then such a company has all the chances and the potential to capture additional market shares, and it are analyzing, dear reader, of industry average costs are higher for this sector – mean that you are analyzing corporation departs from the strategy of cost leadership and is a candidate for disposal of the industry. If you are analyzing business system has lower unit costs than the industry average, then this company has the potential to capture additional market share and has a room for manipulation with the price, which is the main component of this strategy. Effect /which is a conditional, not actual value; and its need will be explained at an example! / from the application of the strategy will be calculated by the formula developed by the author of this paper (9):

![]()

Where: AI (sectoral, industry average) – these are the average in the industry costs indicators, which are to be recalculated for a company under an analysis by using the above formulas; F - these are the actual company’s under an analysis figures, which should be converted into thousands of rubles; COSTS - it is a total value of costs; MC - this are material costs; SOA - is the amount of social security contributions (assignments); AA - it’s depreciation (amortization); OTA - these are other costs; SAS – assignments to the salary fund; COSTS(AI) - means the amount of costs that would have an analyzed by you, my dear reader, company if it had the average in an industry efficiency; COSTS(F) - this is the actual cost, which occurred at the market for an actual company under your actual investigation; MC(AI) - is the amount of material costs, that would have an analyzed by you, my dear reader, company if it had the average in an industry efficiency; MC(F) - it is actually established by the market amount of material costs inside the business system under an analysis; SAS(AI) - these are actually formed in this period payments to the payroll of production workers at a company under an analysis; SOA(AI) and SOA(F) – these are social security contributions, which are respectively formed in a company in fact (SOA(F)), or which would respectively form in a company if it had the same efficiency as in average in an industry (SOA(AI)). AA(AI) and AA(F) - these are amortization fund payments, which a company would have deducted if it had the industry average performance (AA (AI)), and the norms of deductions, which the company is actually doing right now (AA (F)) /actually, in fact, it should have it done before the end of the reporting period/. OTA (AI) and OTA (F) - these are the value of other costs included in the cost structure of production, respectively, as it would be if the company had average industrial efficiency (OTA (AI)), and the actual state (OTA(F)). A positive effect size corresponds to the monetary amount that the company has in reserve as a basis for increasing the maximum cost of one component, which indicates a positive trend in the activities of the company. If you are counting as it is expected according to the method, ie, everything in thousands of rubles, then this amount will also be in thousands of rubles…

If you’ve transformed into other monetary units (starting from the matrix recalculation to the performance of the company you are analyzing), then if you calculate everything right, then the answer you will get in the same amount you provided your calculations. This figure can be viewed in the dynamics, which will give more complete picture of overall trends in the company and its development. The overall effectiveness of the company at the market will be calculated by the formula (10):

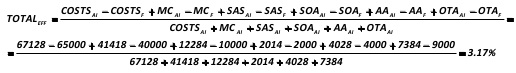

![]()

Where: TOTAL(eff) - is expressed as a percentage average of the more effective use of leadership strategies based on the costs minimization for the Russian company, expressed as a percentage. You can use the following indicator developed by the author of this paper to find a relative measure of company’s performance at the market (we have already counted an absolute indicator of efficiency), which shows the extent to which the average analyzed company can be successfully compared with its competitors (11):

![]()

Also, all the elements of material costs should be compared with industry averages, which would have the following simple algorithm. To calculate the efficiency of the total cost you should use the next formulas, developed by the author of this paper:

![]() (12)

(12)

![]() (13)

(13)

Where: EFF (COSTS) index will show the actual amount of money from the effect of company’s strategy in cost leadership. EFF (%(COSTS)) index shows the extent: to which interest the industry average for a selected company is more efficient than of its most part of competitors. Indicator of the effect of material costs will be calculated by the formulas, developed by the author of this paper:

![]() (14)

(14)

![]() (15)

(15)

Where: EFF(MC) index will show the actual amount of money from the effect of company strategy in cost leadership at the above mentioned component of costs.

EFF(%(MC)) index shows the extent: to which interest the industry average of this company is more efficient than among its competitors in the abovementioned indicator. Indicator of the effect of contributions on wages of production workers (payroll) will be calculated by the formulas, developed by the author of this paper:

![]() (16)

(16)

![]() (17)

(17)

Where: EFF(SAS) index will show the actual amount of money from the effect of company’s strategy in cost leadership at the abovementioned component of costs.

EFF (%(SAS)) index shows the extent: to which interest the industry average of this company is more efficient than among its competitors in the abovementioned indicator. Indicator of the effect of social security contributions should be calculated by the formulas, developed by the author of this paper:

![]() (18)

(18)

![]() (19)

(19)

Where: EFF(SOA) index will show the actual amount of money from the effect of company strategy in cost leadership at the abovementioned component of costs.

EFF(%(SOA)) index shows the extent: to which interest the industry average of these companies is more efficient than of its competitors in the abovementioned indicator. Indicator of the effect of depreciation should be calculated by the formulas, developed by the author of this paper:

![]() (20)

(20)

![]() (21)

(21)

Where: EFF(AA) index shows the actual amount of money from the effect of company’s strategy in cost leadership at the abovementioned component of costs. EFF(%(AA)) index shows the extent: to which interest the industry average of these companies is more efficient than of its competitors in the abovementioned indicator.

If the figures of depreciation (AA) are above the industry average depreciation, then, dear reader, think: maybe it makes sense to use a non-linear method of depreciation… Let’s suppose it is much harder, at the same time, it may be better, because in this case the property will bring major cost of depreciation in significantly faster manner, and in the short term it will be to lower the actual linear rate of depreciation, therefore, it can help the company to adopt a strategy of cost leadership in a more successful manner…. It all depends on the internal examination of the particular company and on whether you can convince your accountant to spend a significant amount of extra time and effort to change the accounting principle…. Indicator of the effect of other payments will be calculated by the formulas, developed by the author of this paper:

![]() (22)

(22)

![]() (23)

(23)

Where: EFF(OTA) index will show the actual amount of money from the effect of company strategy in cost leadership at the abovementioned component of costs. EFF(%(OTA)) index shows the extent: to which interest the industry average of these companies is more efficient than among its competitors in the abovementioned indicator. Let us, for clarity, consider the following example. Co Ltd “Kama” is specializing in the production of premium sort grain, and it adopts a strategy of cost leadership (and, therefore, the price leadership); the company has the following performance measures: revenue per year: 100 million rubles. Cost per year of 65 million rubles, Including material costs: 40 million rubles, Payroll (labor costs): 10 million rubles, Social deductions in 2 million rubles, depreciation: 4 million rubles, and other costs: 9 million rubles. For simplicity let’s assume that these indicators are already counted with the actual accuracy to a penny.

Let’s calculate the effectiveness of leadership strategies based on the costs leadership for the company. First, let’s compare the activities of a company with an industrial branch of activity from the scheme above. It is clear that it would be agriculture. Now we calculate the K index. Since the company uses calculus in millions of rubles in reporting, the index is equal to 1.000.000/1.000 = 1.000. Let’s recalculate all the figures in accordance with the coefficient K: Revenues for the year: 100,000 thousand rubles. Cost per year: 65,000 rubles, including, material costs 40,000 rubles, Payroll (labor costs): 10.000 rubles, Social deductions: 2,000 rubles; depreciation: 4,000 rubles, and other costs: 9,000 rubles. Now we should use the coefficient β of the above formula, which will transfer the activity of the analyzed company into conventional activities: such as if it worked exactly in accordance with industry standards:

![Now we should use the coefficient β of the above formula, which will transfer the activity of the analyzed company into conventional activities: such as if it worked exactly in accordance with industry standards: [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/e1.jpg)

The calculated values show what would be the cost structure of company at the market, if it had the industry average profitability. It should be noted that if the statements of the company has a value measure in thousands of rubles, the cost averages can be calculated to within cents. In this example, the goal of ideal accuracy is not placed, because the data have been rounded. Now let’s calculate the monetary value for the effect of the use of leadership strategies on costs:

![Now let’s calculate the monetary value for the effect of the use of leadership strategies on costs: [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/e2.jpg)

What does this quantity perform? It shows just how much better are the company’s activities in terms of money per lumped component costs, taking into account the structural component. This is a conditional value, not an actual one. The overall effect of the application of leadership strategies based on the costs for Co Ltd “Kama” is

The company “Kama” is 3.17% advantage over industry averages for cost leadership; it is an important indicator for the business systems that use the specified policy of positioning in the market segment. This figure could turn out negative … and that would mean that perhaps the company should position itself not as a “leader in cost” in order to maximize turnover, and in some other way… Maybe it should try a strategy of positioning its products (differentiation) by, for example, quality, or to diversify its production (it to be ‘sprayed” into many small components; an example of diversification: the company was selling chicken carcasses, and after it began selling smoked hen, chicken sausages, baked hen, …. .), or to do something else, and it is likely to deviate from this strategy, of course, if there is no real possibility in the near future the drop the products price down. Let us, together with you, calculate the other comparable figure of the effect:

![]()

This indicator is relative, because the cost is laid in it twice (total and within components). It is intended to compare the company with its direct competitors, because this figure, in contrast to the overall efficiency, puts more stringent conditions: whether the company can cover the cost by its reserve for more than two times or not! If it can at a sufficient level – the cost leadership strategy can be applied for such a company – moreover, this is, most probably, the strategy that the company needed. The sufficiency level should be estimated by comparing the company under an analysis with its direct competitors by the same formula, which calculates the efficiency.

If the level is insufficient – you, my dear reader, should ask yourself a question: if we can also look for a different strategy in positioning its products on the market? The company has this figure turned low, only 1.09% of the benefits! Quite possibly, it either should seek additional strong reserves to reduce production costs (for instance, by growing the grain of non-premium class), or to change its strategy for differentiation or costs-leadership-diversification; for example, by going directly to consumers through a network of millers and bakers shops, which could differentiate its production by selling cheap bread and pastries or bread-stuffs, which could or would be a continuation of the strategy of cost leadership or differentiation strategy (eg if the bread and pastries will go of a different quality, assortment (cakes, pastries, white and black bread, biscuits, sweet pies and so on).

If the average cost of grain is higher in a selected area or region, than average in Russia (for example, grain production in the far north regions (eg, Yamal-Nenets Autonomous District)), it is possible that the specified rate is good enough for the implementation of the cost leadership strategy. It can be found by direct comparison of the company you are analyzing with the competition environment. As these examples are more the exception than the rule, therefore, in such case, there are not many competitors in the region, that is why the market analysis should not take much effort. It should also be taken into an account: the possibility of entering at that market segment the competitors from other regions in which the figures can be close to the industry average! You should also calculate other performance indicators for company at the market:

![You should also calculate other performance indicators for company at the market: [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/e5.jpg)

![You should also calculate other performance indicators for company at the market: [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/e6.jpg)

These calculations indicate that a company, as a whole, has the ability to use cost leadership mostly due to savings on salaries (23%). Other indicators of effect, on average, are “eaten” by too exaggerated proportion of “other costs”. The above demonstrates that the company is not yet ready to make a strategy of cost leadership! This policy of positioning products in the market requires special cheap manufacturing technology, not just salary savings! Company needs to upgrade the technology or to make the production of grain using a cheaper technology, or switch itself to a different strategy, that is, the positioning of products (differentiation), which I, together with you, dear reader, will consider in the future. By the way, please, do not forget that the specified model should look at the dynamics in order to know on what are the trends in the company’s development! We have examined a model developed by the author of this paper of mono-parametrical segmentation of the Russian company in the market. We have examined segmental matrix system of industry average costs. You probably ask me: “And is it all for companies which use a strategy of cost leadership in the market or not?”.

My answer would be: “Actually, no”. Firstly, the technique itself is to be used not only for companies which use the cost leadership strategy, and also for other companies because the cost – it is an important (with the exception that is not the only) quality indicator also for a model of differentiation. This matrix is useful for calculating the companies, primarily producing more or less uniform and comparable to the industry average production. Other companies may simply compare themselves with industry averages. Secondly, this technique is designed to analyze the company’s strategy and cost leadership adequacy from the inside …. – in order to have a complete picture about the situation in the market – a company must also know the position from the “outside”, ie, at the market. This is the way we are going to follow with you, dear reader, now. Alexander Shemetev’s model: Segmental model to estimate the position of Russian companies at the market Generally, what is a comparison of one company with another? What is the comparison of company with the market in which it exists?

In a typical embodiment, it is a comprehensive comparison of company’s basic elements with other companies. It is in normal form. There, in any case, a model should be created, – a model with the set of evaluation parameters: it is not important, external or internal this model is relative to the target firm – all the same: at least a few parameters should be taken. And here’s the model of leadership at costs, which has it in another way …. There is only a single internal and most important parameter which estimates the efficiency: the cost and price of the finished commodities! All other parameters should not be important for this kind of policy of the firm, otherwise, it’s a different strategy…. When evaluating a business system in the environment all at about the same: only one important parameter, which is already associated with volume of sales: revenue!

The second direction of leadership on costs strategies which is directed outwards, is expressed in …. maximization of trade, that simply puts the company’s revenue …. How to evaluate: whether the current level of revenue is sufficient for the satisfaction of certain corporations according to the mono-parametrical model? It possible and, even, it is necessary to rate it. My dear reader, please, note that we are not talking yet about the profitability or the structure of the book value of a company – just about asset turnover, about an index, maximization of which is the goal of an average company in the market from a position of cost leadership. The more efficiently the company carries this goal out, the more effective it is fighting against competitors. Other analysis, for business systems of this strategy, is secondary – you, together with me, will see its algorithm a little later. In the meantime, let’s analyze the segmental matrix system of the cost-leadership-strategy of company positioning at the market on the company’s turnover indictors:

Segmental matrix system of the turnover of capital of Russian companies

in average in the industry

![Segmental matrix system of the turnover of capital of Russian companies in average in the industry [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/t2.jpg)

Where: Rev - Revenue sum for the reporting period; OC(Eq) - the total book value of owned capital (equity); TAS - total balance sheet sum (company’s book value sum); TL - total liabilities” sum; AP - accounts payable; AR - accounts receivable. A/C , FEC-1and so on – are the names of the industries, which are given above. The above matrix was compiled and developed by the author of this paper based on an analysis of 100% of the companies of mentioned sectors in the Russian Federation from 2003 to 2010 (the end of 2010 is taken analytically). The above matrix characterizes the average turnover of capital of companies of listed industries (transcript of the names of industries cited above). It can be seen from the scheme that the minimum capital turnover is typical for companies involved in mining and processing of fossil fuels and minerals sectors, as well as real estate, agriculture, wood industry and metallurgy with its attendant sub-branches. The maximum capital turnover is associated with the sphere of education, as well as retail trade and wholesale trade, textiles and food, printing and publishing sectors.

These production types undertakings constantly brings to its owners a “live revenue”, which can be crucial to long-standing cycles of production and industrial companies (in case of diversification of their activity). I’d like to make a reservation for one type of industrial companies: of the agro-industrial complex (AIC). As it can be seen from the scheme, agriculture has a very low turnover of capital and the scope of food supply – has it moderately high. The average asset turnover for AIC companies (that combines production and processing of products) is about 1, that is, revenue at them is comparable to the amount of assets. We must now return to the analysis of a company in the market, whose market policy position is cost leadership. The purpose of such company as you, dear reader, remember, is to maximize the rate of business turnover / revenue sum related for any indicator /. Let us compute the external effects of leadership on the costs policy for business-system for a certain branch (internal effect, as you, dear reader, remember, is associated with the minimization of costs, which we have analyzed earlier). The total external / market / effect of the use of cost leadership strategy for domestic companies is (25):

![We should now find the value of correction factor in the micro-segment, Ar: [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/e25.jpg)

This indicator is an upper threshold of performance. The overall effect of accounts receivables and payables management policy is directly related to the maximization of sales:

![MicDy – is the market share, calculated at the rate per one year. [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/e26.jpg) (26)

(26)

Where: (Rev/TAS)f and (Rev/TAS)ai- are, respectively, actual and average in an industry / taken out of the matrix system / assets turnover; (Rev/ OC(Eq) )f and (Rev/ OC(Eq) )ai - are, respectively, actual and average in an industry / taken out of the matrix system / equity turnover; (Rev/TL)f and (Rev/ TL)ai - are, respectively, actual and average in an industry / taken out of the matrix system / total liabilities (borrowed capital) turnover; (AP/AR)f and (AP/AR)ai - are, respectively, actual and average in an industry / taken out of the matrix system / accounts payables and receivables ratio. Along with the overall effect, it should be calculated also the private effect of applying by a company this strategy of leadership in cost for each indicator. In terms of total asset turnover it is calculated in the following way:

![For our example, the share of other companies in the market segment is in absolute values: [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/e27.jpg) (27)

(27)

In terms of OC(Eq) turnover, effect is as follows:

![]() (28)

(28)

In terms of TL turnover, the effect is:

![For our company, the shares they occupy in the sub-segment of the consumer market’s micro-segment are: [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/e29.jpg) (29)

(29)

The average of these three variables (EFF(M(TAS)), EFF(M( OC(Eq) )), EFF(M(TL))) - is a lower threshold of performance for successful in this strategy companies. Let us consider, for illustration, the following example. Let all be the same: same Co Ltd “Kama”, which has revenue of 100 million rubles and applies a strategy of leadership in cost, has the following balance sheet indicators: OC(Eq) = 70 mln., TL = 50 mln., TAS = 120 million rubles; AR = 30 mln., AP = 28 million rubles . Let us compute the external effects of its operation at the market: ![Let us compute the external effects of its operation at the market: [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/e7.jpg) Thus, the position of the business in company is so, that the products have quite a high demand, which gives about 51% greater effect of capital turnover of the company than of the average company (plus 51% to the same indicators to the situation if the company worked with average in the industry ratios). The above means that the situation in the market is favorable for the application of strategies based on costs leadership. However, as we established earlier, the internal cost structure has not yet involved the use of the above mentioned policy of positioning of the goods; it is clear that the re-organizing of production in order to minimize costs may have good reason for a company. It should also be evaluated other performance indicators for business systems on the market:

Thus, the position of the business in company is so, that the products have quite a high demand, which gives about 51% greater effect of capital turnover of the company than of the average company (plus 51% to the same indicators to the situation if the company worked with average in the industry ratios). The above means that the situation in the market is favorable for the application of strategies based on costs leadership. However, as we established earlier, the internal cost structure has not yet involved the use of the above mentioned policy of positioning of the goods; it is clear that the re-organizing of production in order to minimize costs may have good reason for a company. It should also be evaluated other performance indicators for business systems on the market: ![It should also be evaluated other performance indicators for business systems on the market: [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/e8.jpg) This ratio shows that the ratio of the company’s accounts payable and receivable is lower than the industry average, which gives some reserves in an amount comparable to the 23.2% for the manipulation of credit policy / debt management / in the company. The above ratio is likely a reference indicator. However, exceeding the industry average figures can be detrimental for a business system (in this case, the ratio would have turned out negative). You should also calculate other indicators:

This ratio shows that the ratio of the company’s accounts payable and receivable is lower than the industry average, which gives some reserves in an amount comparable to the 23.2% for the manipulation of credit policy / debt management / in the company. The above ratio is likely a reference indicator. However, exceeding the industry average figures can be detrimental for a business system (in this case, the ratio would have turned out negative). You should also calculate other indicators: ![You should also calculate other indicators: [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/e9.jpg)

That is, on average, each performance indicator demonstrates the effectiveness of 34% on average. It should be noted that overall performance has turned out more than 51% due to the fact that the efficiency ratio’s denominator has not actual figures, and averages in the industry, which for a successful cost-leadership company must be lower than actual, which, in its turn, therefore, raises the effect. This effect means, that the company sells an average of 34% – 51% more output from the calculation of the size of the book value than the industry average competitor, if he had a similar book value.

The advantage in this indicator means that a company may adopt a strategy of cost leadership due to the fact that the sales volume of such company, therefore, the market share is significantly higher than the industry average. The said method can be applied to other companies, employing non-cost leadership strategy. It is good to apply this method to see the trends of company’s development.

Thus, we with you, dear reader, considered developed by the author of this paper methods of how to segment the domestic companies, especially those that use the cost leadership strategy. Let us now consider how we can segment the companies using different strategies. Leadership Strategy for the position (differentiation) suggests that a certain company produces a product that should be allocated in the positioning and be notable among competing products. How can somebody stand out among the products of competitors and what do these products and competitors? Probably, most successful answers were given by Michael Porter (M. Porter, 2006), the answers to the whole set of questions about products, competitors and manufacturers. He brought the theory of five forces that influence to the company positioning at the market: the strength of competition of direct competitors that seek to capture the market; the competitive strength of potential competitors, including from related industries who seek to enter the market; the strength of cooperation with potential partners and real companies (suppliers, dealers, banks, …); the strength of cooperation with clients; the strength that comes from challenge from substitute products in the market.

![]() Substitute product – is a product which, because of its special qualities and characteristics to consumers, is able to partially or completely fill the need for clients in a particular type of goods, works or services. For example, the video recorder can be completely replaced by DVD-player. Video recorder can be partially replaced by computer and more partially – by palmtop. Sometimes we can meet rare species of goods at the market for which there are practically no substitutes, such as salt.

Substitute product – is a product which, because of its special qualities and characteristics to consumers, is able to partially or completely fill the need for clients in a particular type of goods, works or services. For example, the video recorder can be completely replaced by DVD-player. Video recorder can be partially replaced by computer and more partially – by palmtop. Sometimes we can meet rare species of goods at the market for which there are practically no substitutes, such as salt.

A different set of answers to questions about how products can stand out among their own kind, perhaps, more successfully was managed to bring by the first classic of marketing: Philip Kotler (Ph. Kotler, 2008). He and his followers believed that the basis of demand for the product itself is the end user, which can be either a series of industrial companies, or individuals. In the case when customers are private individuals, in this very case, the product should be allocated by the regional (for example, to turn up the place in a good region, to put a store in the city center, or vice versa, on the outskirts, to calculate the effect from local outlets, ….), demographic (for example, to produce goods for men only or for women only, only for kids, only to married couples, for families of class A and so on ….), psychographic factors (for example, to create fashion for the goods, or a fashion trend, to rearrange the goods at the “rails” like goods to snobs, to investigate the psychological types and consumer groups, which will be expected to buy a certain sort of goods, and so on). If the market is concentrated to industrial cunsomers, the groups of factors, in this case, becomes more than three – more precisely – five: microenvironment (the economic sphere and the economic sector, company size, geography, points of production and marketing, … ..); the internal environment (technology, sales and delivery , the structure of financial flows, the orientation of marketing-management, staff motivation, ….); the overall commercial relationship between each customer and the producer (the presence of purchases and sales centers, responsibility centers, the procurement criteria themselves, purchasing additional conditions and other factors); private commercial relations between each consumer and producer (urgency, lot and order sizes, quality, delivery and payment conditions, ….); the internal psychological characteristics of managers of clients-firms with whom the company maintains close working relationships.

I hope I was able to answer your questions as to what differentiation strategies are common features for the companies whose clients are private individuals or even business-systems. We can now proceed the consideration of issues related to the manner in which to segment the Russian companies using these positioning strategies of the goods at the market. As you may remember from the scheme, the author of this paper developed two models, which allow to segment this type of firms at the market: factor model and multi-segmentary model, which consists of models of multi-segmentary analysis of consumer and of multi-segmentary analysis of market itself.

Alexander Shemetev’s model: model of factor segmentation of Russian companies at the market

The worldwide used today factor model – it was originally Russian development. The founder of the method, Mr. Kriylov (Kriylov, 1906, 1918), was once thinking about how to assess a new man-of-war (military ship), if it is only known this new ship is better than the old one. Military ships at those times in Russia just came from made of wood man-of-wars to the heavy ironclads (it was 1903).

Each heavy ironclad had thousands of important components – there were no computers at those times to estimate each of them – so the problem on how to estimate a new heavy ironclad that consists of thousands of new details was almost an un-decidable arithmetic no one could calculate. At least, in 1904 he started to follow this way and tried to calculate the cost of only one new heavy ironclad. A year after he understood it is useless to make such like deep calculations, to spend too much time and recourses with no result at all: for the whole year he couldn’t find a cost of only one new heavy ironclad, and, of course, the problem on how to estimate many new heavy ironclads was irresolvable and impossible to be calculated. He understood there were too many details to be gathered together for the analysis. And in 1906 he put forward the revolutionary proposal: not compare the extent to which one part is better or worse than another one, and to compare the parameters themselves /that today would be called: “marketing product parameters”/, which primarily evaluated the battleships: the thickness of armor, speed, agility, tools, metal consumption in production and so on. Unfortunately, this method wasn’t used I Russia: in 1906 Russia suffered of the first attempt of revolution, then the First world war and the second Russian 1917th revolution.

The revolution of 1917 ousted the method to be used on a single shipbuilding yard: in St. Petersburg, where it was applied. In 1917th Mr. Kriylov immigrates to the West, where, in the U.S. in 1918 for the first time, this method became widely known to the public. Large U.S. companies gradually adopted this method to be used. Late 1930s – early 1980s was the “finest hour” of this method: the world’s largest business giants adjusted their models for this method: not only in pricing as it was before 1930th – they started to use it for the market segmentation to compare the advantages of each company among its competitors. Each company then developed its own mathematical model of market segmentation on the basis of the Kriylov’s method. The method has three equivalent choices: multi-matrix, petal, and web-analysis (arachnoid, and not the internet!) – from the names of which there are two types of diagrams: the Arachnoid diagram and the petal diagram. The crisis of the mid-80s, as well as some of the earlier crises in developed countries, showed that the company may actually be competitive in the face of all the competitors, and in fact, be declared bankrupt (such as the construction company of William Stern, a corporation of hospitality (hotels and restaurants) industry of Harvard graduate Jacques Borel who used these methods).

Thus, large companies began to move away from this method in favor of a cluster analysis of the market. However, this does not mean that the method is not used at all – it is used by virtually all major companies in the West, not just as the only method of evaluation of segmentation in the market. The value of this method is great: for the first time it managed to oust from the use the mass-marketing method / targeting only internally to the company itself and its ability to produce production for mass consumption without differentiating the properties of finished commodities/, which was very common in the early twentieth century. This method also increased much the technical orientation of the production and, due to this, we can now easily buy commodities with highly developed technical parameters, which is an important part of out today life.

Adaptation of this model of market segmentation for the use in Russia, unfortunately, has been neglected – the method was seen as mainly theoretical for price-making. The author of this paper has tried to adapt this method for use in Russia for market segmentation. The author of this paper believes that market segmentation can be done by dividing the production activity in certain product lines, which can be compared with the same indicators of competitors. The aim of the method of calculation should be the total score of the effect of each production line of products. Under a line of products can be understood any comparable output; the product should be comparable within the same products and obviously different from consumer characteristics of other products produced by company. Each such product has significant consumer characteristics on the important parameters.

There are three types of factor models that are suitable for the segmentation of domestic companies on the market: scoring model, point-weight model and the regression model. Let’s examine them in more detail. The use of scoring models for the segmentation of the Russian market Scoring model assumes that the main characteristics of goods in the production lines are already set in the market for this reporting period, and that each characteristic is equivalent with respect to other characteristics. Then compare the resulting characteristics of the amount of points can be carried out through qualitative characteristics: a fair price or a comparable price.

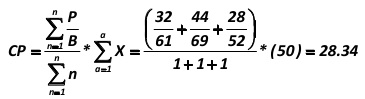

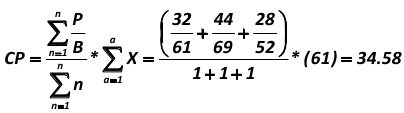

It should be noted that the fair and the average price for a company may be different from the market. The fair price of the production line – this is the actual amount of the valuation of all the useful features included in the product line at a market value except for the price itself. The comparable price – is the actual amount of the valuation of all the useful characteristics of the product, including the market price. The comparable price for a unit of conventional product (ComP), a member of the company’s product line is:

![The comparable price for a unit of conventional product (ComP), a member of the company's product line is: [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/f30.jpg) (30)

(30)

Where: ComP - is the theoretical value of the average cost of one point on the parametric range of products in terms of money. P - is the average price of the product line items of a competitor in the market. ΣB - a score line of products for products of some competitor at the market. n - is the number of competitors for this product line at a market. a - is the the total number of points that are scored on the same index by a production line at the market. X - is the average score for a production line product. Fair price (FP) for conventional production units will be assessed as follows:

![Fair price (FP) for conventional production units will be assessed as follows: [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/f31.jpg) (31)

(31)

Where: ΣB (Pr) - is the sum of the points on the line products on the market of a some competitor, expressed as in the assessment of points on the price of the commodity itself. X (Pr) - is the average score for a production line product, estimated at the price of the goods.

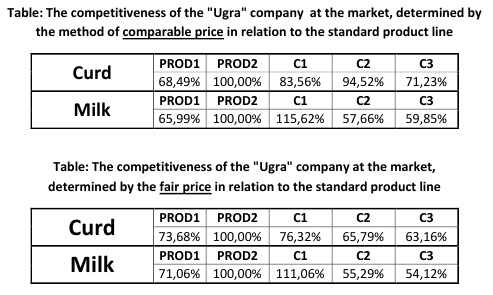

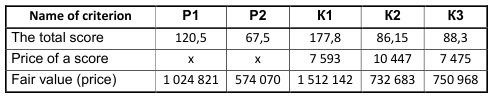

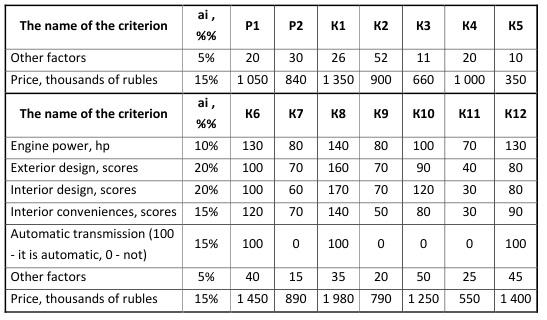

To simplify the perception of sign of the sum (Σ) in front of B, there will not be put in front of B in the future, so, dear reader, just be aware, that this is already included in the calculations. For a more visual representation of the method, let us consider the following example. Company Co Ltd “Ugra” produces two product lines (two types of goods on a single line of output): curds (“Normal” and sweet curd called ‘snowball”) and dairy products (milk called “Normal” and ‘skim rustic” milk (SRM)). For simplicity, suppose in each line there are only two of the above products. Imagine that a company has three competitors (C1, C2, C3) on each line. The method of market research established the following characteristics of cottage cheese:

Table: Estimated characteristics of the curds at the market

![Table: Estimated characteristics of the curds at the market [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/t3.jpg)

![]() Comments to the Table: 1 U.S. dollar is circa 30 rubles.

Comments to the Table: 1 U.S. dollar is circa 30 rubles.

It should be noted that not in all cases the calculations should be based on comparable prices in the analysis, especially if the price per unit of product is too high, which will absorb the significance of other factors. However, even at a high price – the comparable price will stay a comparable a factor of comparison with the competition environment, simply the significance of analysis may be lost in this case – that is why it is better to use a fair price analysis.

Analysis at a comparable price is able to take into consideration the market price as a parameter, when it is not estimated with the use of some regression model (due to a complexity of mathematical model in this case). Comparable price makes the specified form of analysis applicable to estimate the production unit which sum of “weight” scores is not too big, at least, roughly, less than the sum of points for the highest quality product on the market. If the total score is significantly less than the market value per unit of output, then the analysis should be used at fair value. In more simple language you, my dear reader could easily understand what is the comparable value, we can’t compare, for instance, a package of curd that weight if 300g with the package of curd produced by some competitor who put its curd into a 1 kg package – the price per package should be comparable.

The weight – is not the only parameter that differs one product from the other one, there can be tens or even hundreds of important for customer parameters that should be estimated; besides, weight parameter is usually estimated at price parameter prior to the analysis itself, because its significance can be expressed through comparable with the other products at the market segment prices. Dear reader, please, note: comparable commodity’s value (price), as we shall see from our example, is not a method to make conclusions about the fair prices on some kind of commodity at the market – it just is a tool to compare goods on both price and quality characteristics.

Fair price, in a simple language, is a situation when the sum of scores for a certain product, for instance, a curd, is estimated at a market price without it to be too much high or too much low – these products should be analyzed in a special way in this kind of analysis or replaced to be used in another group for an analysis. Thus, it is seen the “Normal” and ‘snowball” products have serious competitors.

How to assess the competitiveness of the production line at the market? How to dete RMI ne the quality of that segment, which has the conditional Company “Ugra”? Let’s use quality characteristics. Let’s calculate the price of a comparable product with the properties that we were able to compare within this product line competitors. First, we calculate a comparable price for the ‘snowball”:

![First, we calculate a comparable price [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/e10.jpg)

The comparable price for curd “Normal” is:

The comparable price for cottage cheese “K1″ under given conditions is as follows:

Similarly, we dete RMI ne that a comparable price for curd C2 is 39.11; and for curd C3 – 29.47.

These costs are in rubles. It can be seen through the comparable value that the ‘snowball” surpasses all similar products and that the main competitor for it – is a curd C2, with whom they share the main market segment of high-quality curd-cheese. However, one shouldn’t draw conclusions about whether the price is acceptable on the basis of comparable value. A comparable value is intended to show the products of competitors in both price and quality characteristics, so that products can be compared with each other.

Another method to dete RMI ne a company’s competitiveness in the market is a method for dete RMI ning fair value. For the curd-cheese ‘snowball,” this figure will be:

The price above reflects the fair market value of all the taken into account qualitative characteristics of cottage cheese ‘snowball”. Similarly, it’s easy to calculate the fair value for curd “Normal” – it is 37.61 rubles; comparable to the fair price for cottage cheese “C1″ is 38.95 rubles; comparable to the fair price for cottage cheese C2 – 33.58 rub.; comparable to the fair price for cottage cheese C3 – 32.24 rubles.

Now, let us estimate the second line of products of Co Ltd “Ugra”, milk. Marketing research methods established following characteristics of milk for these companies at the market:

Table: Estimated characteristics of the milk at market

![Table: Estimated characteristics of the milk at market [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/t4.jpg)

Since the mechanisms of the calculations were already analyzed, let’s just imagine the calculated data for milk in the table below: Table: Competitive characteristics of the milk at market

![Table: Competitive characteristics of the milk at market [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/t5.jpg)

It should be noted that in some cases the volume of container can be included in “other factors”, although it can also be used in the main (through a comparable by volume price). Now let’s estimate the company’s competitiveness at the market for scoring models. Competitiveness of the company by the method of comparative prices has the next appearance:

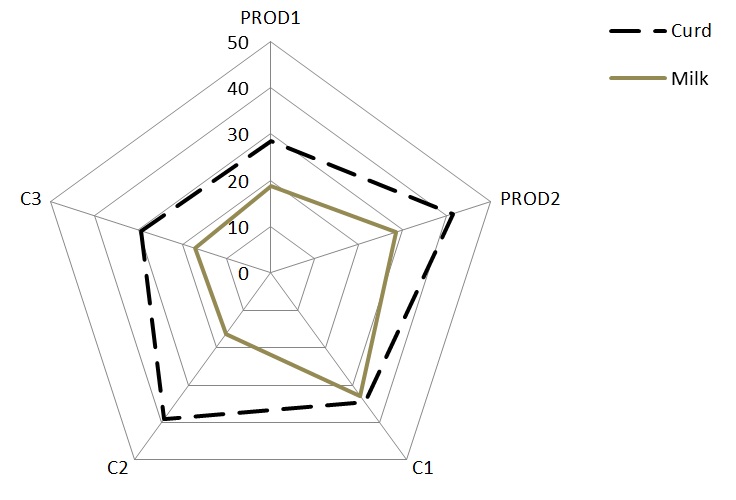

Arachnoid Chart: Competitiveness of the company “Ugra” in the market, dete RMI ned by the method of comparable rates

Comments to the chart: ![]() PROD1 and PROD2 at the chart – are the conditional abbreviations for Product 1 and Product 2 for milk and curd;

PROD1 and PROD2 at the chart – are the conditional abbreviations for Product 1 and Product 2 for milk and curd; ![]() The chart is estimated in comparable prices in rubles. As it can be seen from the graph, company “Ugra” has a good market competitiveness. It is important also to dete RMI ne the company’s competitiveness at the market by a fair price:

The chart is estimated in comparable prices in rubles. As it can be seen from the graph, company “Ugra” has a good market competitiveness. It is important also to dete RMI ne the company’s competitiveness at the market by a fair price:

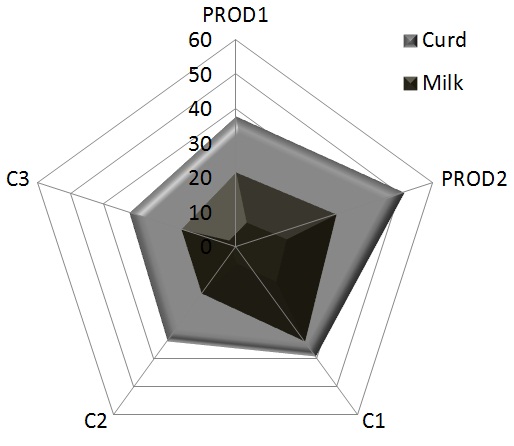

Arachnoid sector chart: Competitiveness of the company “Ugra” at market, defined by the fair price

As you, dear reader, may see, there are two main competitors of Co Ltd “Ugra” in general comparable and quality characteristics: C1 in milk and C1 in curd. Co Ltd “Ugra” has the leading segment of the market at curd and milk production, at the same time, perfo RMI ng the price differentiation strategy by sharing the products on cheap with sufficient quality and more expensive with high consumer properties.

There is a more demonstrable way to represent the volume of segment of the market by company’s competitiveness index at the market. For these purposes, the fair or comparable price for the main line of each type of product (it can be chosen the most competitive product on each line) should be transformed according to the following formula, developed by the author of this paper:

![There is a more demonstrable way to represent the volume of segment of the market by company's competitiveness index at the market. For these purposes, the fair or comparable price for the main line of each type of product (it can be chosen the most competitive product on each line) should be transformed according to the following formula, developed by the author of this paper: [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/f32.jpg) (32)

(32)

Where: CCPAI - this is an aggregated index of competitive product lines to competitors in the market comparison; FCP - it’s a fair or a comparable product price, depending on the method chosen; A - is the best chosen for the analysis product among the company’s lines and its competitors (the “best” may mean maximum scores, or any other product you wish to compare with the other products); i - is the i-th product of a product line of the company and its competitors, which occupy a similar market segment. So, if we transform the competitiveness indicators of the “Ugra” company in accordance with the above formula, we obtain:

Table: The competitiveness of the “Ugra” company at the market, dete RMI ned by the method of comparable price

in relation to the standard product line

The rebuilt Arachnoid diagram s for these indicators are able to demonstrate the company’s competitiveness in the market segment relative to the reference product for which it should be noted, or it can be taken any specific product lines to analyze. These figures show the percentage of lines in other products differ of competing companies and other internal lines of the company in relation to the reference product.

However, the method of dete RMI ning the market segment and the company’s competitiveness at the market by the scoring model has some drawbacks. Among these major shortcomings should be noted that the points, which are earned by various characteristics, are considered fully comparable and equal for the market consumption. Thus, in the example above, the scores for the fat content of milk were compared with scores on time till expiration date (for each 1 day 1 point was put) and with scores on the design, expressed in 10-point system of measurement. However, not all these properties can be equivalent for the consumer: she or he gives some more properties, gives more preference to one products more than the others.

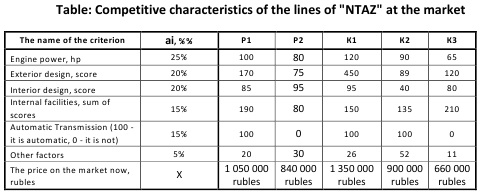

If this deficiency is essential for production, and it can’t be eliminated within the above method, it may have value to use a different method like point-weight model to dete RMI ne the competitiveness of the market segment of company. The use of point-weight model for the segmentation of the Russian market The model also assumes that the company produces the same type of production lines. However, as noted earlier, the company may belong to any industry and any method of production – it is important that a set of products, which are included in the line, was qualitatively comparable.

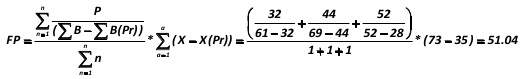

The difference between this model and the previous one is that the scores on the parameters of the line products are not equal, and they are amenable to mathematical discrimination. Another difference between this model and the previous method is the lack of a regression function of the price, knowing that abstraction is taken, according to which the price is not a factor which is derived from the internal characteristics of products available in the market. Thus, these abstract “brushes aside” the possibility of applying the method of comparable prices. Assessment of the company’s competitiveness in the market and the adequacy of its occupied segment is dete RMI ned by calculating a fair price, which is designed to dete RMI ne: whether the manufacturer’s price for the continued development of line of products is adequate in the segment for the given parameters of significance. A fair price for the product line (FPi) is:

![A fair price for the product line (FPi) is: [Alexander Shemetev]](http://content.snauka.ru/web/6009_files/f33.jpg) (33)

(33)

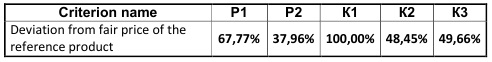

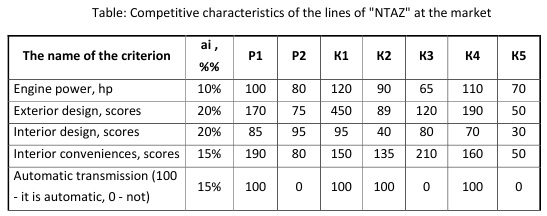

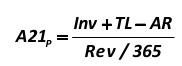

Where: ΣBk – is a score estimated at the rate for one production line of the analyzed company with taking into an account of the particular importance of each component; n – is the number of competitors, P – is the price per unit of output; ai – is the importance of the i-th parameter, described as significant in the conducted market research; Bi – is a score of the i-th factor, which is included in the calculation of this model.