The practice of economic activities of Russian enterprises shows that prevailing economic conditions dictate the need for optimum management of enterprises, corporations and their resources, including improving the quality of their financial management.

The procedure for the calculation of the value of the entity allows it to successfully transform and implement improvements to enhance its competitiveness in the market. Also valuation of business entity provides objective information about the potential business entities for its strengths and weaknesses, possible threats and on the development prospects of the economic entity and the financial condition of the organization. All users of financial information are interested in an objective assessment of the market value of the company, despite the fact that they have different objectives: owners, managers, workers, consumers, investors, government, population, financial institutions.

It should be noted that issues of evaluation are fairly debatable, but it should be noted that, despite the considerable debates related to the evaluation of the organization, objective definition of the value of a company is quite difficult and is the actual definition of optimal parameters and methods for getting the most realistic valuation of the company.

A realistic valuation of the company represents the market value, which in turn implies a “probable price at which a given object of evaluation may be alienated in the open market in a competitive environment, when parties to a transaction act reasonably, having all necessary information, and the value of the transaction does not reflect any extraordinary circumstances, including:

one of the parties to the transaction is not obligated to dispose of the object, and the other party is not obliged to accept execution;

- the parties to the transaction are knowledgeable about the subject of transaction and act in their own interests;

- the object of evaluation is shown in the open market through a public offer typical for similar objects of valuation;

the transaction price represents a reasonable remuneration for the valuation object and coercion to commit the transaction in respect of parties to the transaction from any side;

- payment for the valuation object is expressed in monetary terms”.

When assessing the value of the company, there are different types of prices (options pricing).

So there is the market price of the company, which implies a determination of the value of the company in accordance with market conditions. Determining the market price of the company usually is thus: “the basis of the market price of the transaction, serving as a result of matching the seller and the price the buyer is the inner value-the value, as quantitatively defined in terms of a particular market, represents the market value”.

The dictionary of modern Economics defines market value as follows: “the current value of goods and services, including commodities, stock values and currencies based on supply and demand at any given time in the market” [1, p.193].

In studies on the management of the company’s market value within the concept of sustainable development of the company the market value of the company is considered “the concept of economic, environmental and social co-evolution. Its meaning is reduced to the recognition of the existence of real market value of the business as based on private (individual) preferences, and reflecting public interests, which cannot be reduced to private. If the preferences of companies reveals the market, the preference of companies in market process of self-regulation do not exist: they are determined by government agencies and public institutions. It is obvious that the interests identified by state agencies, cannot be reduced to the preferences of the business, identify the market through its cost. Each of the participants in the business process claims for a certain amount of total capital required to implement their interests. Formed according to different laws in different institutional environments, these interests come into conflict at the stage of their implementation – in the fight for scarce capital,” [1, p.194].

Given the above “market value” can be interpreted as including the objective of economic, ecological, social relations between organizations, owners, employees, public organizations and state bodies which are formed on the integral and efficient use of total capital and distributions received by the company net profit and added value.

The evaluation of the company there is also such a factor as the investment cost, which implies a monetary value of the object of evaluation to a specific person or group of persons if required by the person (persons) investment objectives the use of the subject property.

In the process of defining such a measure as costs in contrast to methods of determining the market value is optional based on the probability of exclusion for the value of the investments in the open (effective) market. Such rate as the investment cost of the organization can also be used to measure the efficiency of investments.

Also in the process of evaluation is based on the measure liquidation value of the company. This figure is a calculated figure, reflecting the most likely price at which a given object of evaluation may be alienated for the exposure time of the object and less of the typical exposure period for the market conditions when the seller is forced to make a deal on alienation of property. It should be noted that in determining the liquidation value unlike the determination of the market value takes into account the effect of extraordinary circumstances that force the seller to sell the property assessment on conditions of the market.

The cadastral value is: “the value assigned as a result of the state cadastral valuation or as a result of consideration of disputes on results of definition of cadastral cost or in certain cases under article 24.19 of the Federal law No. 135-FZ “About estimated activity in the Russian Federation”.

It should be noted that in order to determine the market value of the organization evaluation of companies typically use three methods: the method based on the estimated income that could potentially bring the organization; the method is based on the estimated costs that will be required to incur in the event of the creation of a similar object; the comparative method uses the value of the same object (organization).

Approach to assessment based on analysis of income, means the following – “the totality of methods of estimation of objects of civil turnover based on the definition of the expected income that the property assessment can bring to the owner after the date of the assessment, and providing for conversion (recalculation) of these revenues in the current value at the measurement date” [2, p.149].

The income approach is used when there is information allowing to predict, including uncertainty acceptable confidence interval, the amount of future profits that the company is able to bring, as well as the costs associated with the assessed organization.

The determining factors in the income approach are income from them will depend on the value of the business. Higher incomes increase the value of the enterprise market. The essence of the approach is that the cost of business is determined as the present value of all cash flows obtained as a result of its activities.

The approach to accounting of income from the object of evaluation consists of several methods.

The first is the capitalization of future income.

Second, is the discounted value of estimated receivable cash flows.

Income capitalization method involves the use of a capitalization rate to convert annual income into the cost.

This technique involves determining the relationship between current income and the corresponding rate of return. Thus defined, the market value of the organization (business) in accordance with the formula:

RSB=CD/KP, (1)

where:

RSB – figure market value of the organization;

CD net annual income.

KP– factor defines the capitalization;

Discounted cash flow method implies a view of the changing of incomes and expenses in different forecast periods.

If the income of the company is unstable, or uses different capitalization ratios, applied discounted cash flow method. This method involves forecasting the cash flows that result are discounted at a discount rate. The discount rate should include a rate of return to reflect investor risks.

Methodological approaches to the discounting of cash flows assume the use of such a reflecting efficiency of the use of the indicator as a total rate of return on capital. Specified rate – the total rate of return on capital shows how to calculate the relationship between two factors such as the market value of the company and the value of the cash flow and the value of the reversion, which differently is called as the indicator of the terminal value. While these indicators are determined for each of the periods for all the period of time used for the calculations.

The formula to calculate the market value of the company (2) shown below.

MV= ∑ (DPp/(1+ONKp)+ CPn/(1+ONKp))±IK, (2)

where:

MV – is the market value of the company;

t – time duration of the forecast period;

p – the period of forecasting

DP – the amount of the current cash flow

ONK – rate of return on capital,

PSA – the value of the reversion,

IK – adjustment performed according to the results of the calculations.

When conducting the forecasting of future earnings of the organization are invited to consider the possibility (probability) of obtaining such income (profit) regularly throughout the period. Therefore, the income to be received in the future must be attributed to the middle of the reporting period.

Under this condition, the price (market value), provided a constant periodic rate of discount can be expressed as follows:

MV = ∑ (DPp/(1+ONKp)a-0.5+ CPn/(1+ONKp)p)±IK, (3)

Most appropriate to apply this method for organizations that have a history of its financial activities over a sufficiently long period. It is desirable that this period reflected a successful (profitable) financial and economic activity of the enterprise. Also, this technique can be used for businesses in the growth stage or in the phase of stable economic development [3, p.7].

In the case of loss-making organizations this methodology can be applied to a lesser extent, however, this technique can still be applied, as received by the end of the calculations, a negative value can be used for making management decisions.

This technique is most appropriate to apply to organizations that have a history of its financial activities over a sufficiently long period. It is desirable that this period reflected a successful (profitable) financial and economic activity of the enterprise. Also, this technique can be used for businesses in the growth stage or in the phase of stable economic development [4, p.72].

For organizations who received profit (loss) for the financial and economic activities of this methodology can be applied to a lesser extent, however, this technique can still be applied, as received by the end of the calculations, a negative value can be used for making management decisions.

This method should be used with caution in the case of the adoption on its basis of management decisions. The main reason for this lack of retrospection, complicating objective forecasting cash flows in the future.

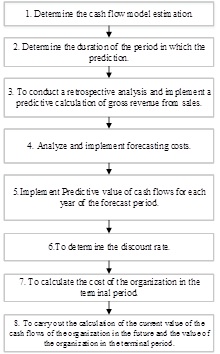

The basic elements of the valuation of the company is shown in figure 1

Index market value obtained in the evaluation is an informative indicator that reflects not only the current market value, but in the case of a comparison with other similar periods can be used as an indicator reflecting the effectiveness of the organization. Also, this indicator can be used for benchmarking to compare companies in the same industry to determine the most efficient companies. Index market value may also be used in the formation of KPI senior managers.

Index market value obtained in the evaluation is an informative indicator that reflects not only the current market value, but in the case of a comparison with other similar periods can be used as an indicator reflecting the effectiveness of the organization. Also, this indicator can be used for benchmarking to compare companies in the same industry to determine the most efficient companies. Index market value may also be used in the formation of KPI senior managers.

It is necessary to note the relevance of the assessment of the market value of Russian petrochemical companies, which are currently experiencing on the one hand the pressure is expressed in decrease in export prices for manufactured products, and the other positive effects of falling prices for oil in US dollar terms, and gas and increased demand for fertilizers and other products in the domestic market.

Авторы благодарны Российскому гуманитарному научному фонду за частичную финансовую поддержку данной работы (Региональный конкурс «Волжские земли в истории и культуре России», грант № 16-12- 63003).

References

- Курилов К.Ю. Анализ деятельности предприятия с учетом влияния цикличности // Инновационное развитие экономики. 2013. № 6 (17). c. 193.

- Ajupov A.A., Artamonov A.B., Kurilov K.U., Kurilova A.A. Reconomic bases of formation and development of financial engineering in financial innovation // Mediterranean Journal of Social Sciences. 2014. Т. 5. № 24. c. 149.

- Курилов К.Ю. Прогнозы развития мировой автопромышленности // Международный научный журнал. 2011. № 5. c. 7.

- Курилова А.А. Формирование эффективной структуры организации // Карельский научный журнал. 2014. № 3. c. 72.

Количество просмотров публикации: Please wait